Teams tackling accounting and expenses often move at a glacial pace due to the laborious processes they follow. And their outdated technology does not help these processes move any faster.

In today’s world, businesses are working at an implosive breakneck speed, in hyper-competitive markets by judiciously utilizing modern resources and automating their systems.

But what exactly is automation?

From purchase orders to supplier invoices to approvals and accounting, there are so many touch points that are still done manually. This means long wait times to process invoices, which can mean unhappy suppliers.

The concept of automation is pretty simple. You take slow, repetitive processes that normally waste hours and let smart software take care of them for you. Automation, basically, minimizes human input and increases efficiency.

Table of Content

What is AP Automation?

AP or Accounts payable automation is the application of technology to automate and streamline accounts payable processes. This minimizes manual operations (such as paper processing, manual invoice keying, and manual invoice matching) and enhances the visibility and control of critical financial data. Accounts payable automation enables businesses to efficiently monitor and manage their spending and generate insights to make smarter, data-driven, and effectual decisions.

AP software fundamentally digitizes the vendor invoicing process to produce account payable processes that are quicker, leaner, and more cost-effective. An online business network that connects trading partners digitally is used in conjunction with accounts payable software to execute this. No more receipts on paper. No emailing of invoices forwarded. No cutting paper checks. In addition to the anticipated cost reductions from removing human operations, automating accounts payable automation can result in significant cost savings for a business. Businesses can reduce fraud risk, eliminate duplicate or incorrect payments, manage their vendor portfolio, and benefit from early payment savings.

Why you should automate accounts payable?

Cash is a company’s lifeblood and the only way to keep it afloat. Regardless of the size or nature of your company, managing your cash flow is essential for the success of your enterprise. Would you still manage the most crucial component of your organization with obsolete, paper-based, manual AP processes? Automation is not just a luxury for huge businesses with big budgets. Every business, from small, neighborhood mom-and-pop stores to ambitious startups to big, global conglomerates with tens of thousands of employees, can and/or already has automated AP. It truly just comes down to customizing a solution to a company’s demands and sizes.

Automating AP makes sense for numerous reasons. Some of these include an immediate, measurable return on investment. AP automation can save your processing expenses by eliminating the need for manual labor. It can also make it easier for you to scale AP as your company expands by negating the need to add staff.

Additionally, AP automation offers solutions that can improve your control over payments and cash flow. Automation of AP can improve your potential to obtain supplier payment reductions by hastening and streamlining the payment process.

Less fraud, fewer mistakes, and easier audits are some additional benefits. Most of the time, automation simply makes life easier for everyone. However, it still requires investment, so let’s look at how automation can be a game-changer for your business.

1. Operational efficiencies

AP automation can benefit your company in a variety of ways by enhancing organizational efficiency. Employees gain from eliminating inefficiencies in the accounts-payable life cycle. Electronic payment of suppliers enables a contemporary method that frees workers to concentrate on more fulfilling work. Automation speeds up the billing and payment process, cutting down on approval waits and boosting output. AP automation solutions can also be linked with existing financial systems, increasing efficiency while assuring information flow between systems.

In the past, people had to wait for invoice approvals since they would linger on desks or in email inboxes for days at a time. If your accounts payable process isn’t automated, it’s likely that your staff members are spending a disproportionate amount of time on activities like data entry, invoice verification, data transfer, account reconciliation, and payment processing. Your team must spend time manually entering data and cross-checking facts. Even if your process is partially automated, staff members still probably spend some time each day reviewing, editing, and approving. This hinders employees from focusing on strategic, value-add tasks that could boost productivity at your firm. These delays are now eliminated with AP automation, which also streamlines and accelerates the entire clearance process. Users of the automation program can obtain a thorough, real-time view of invoice processing through intuitive dashboards. The right individual will receive a timely invoice by setting up specified functions at the same time.

Businesses today are making every effort to engage people and give them the resources they need to realize their full potential. Automation is a simple approach for many businesses to completely transform the accounts payable department, while also enhancing employee satisfaction and boosting productivity. The ability to concentrate on higher-value tasks also helps AP workers find greater significance in their work.

That’s how much more expensive and less effective your team is if you’re still using manual AP practices. You can unleash huge productivity gains and create a more resilient firm by investing in AP automation. What’s not to like?

Automate Your Finances with Synced in Minutes!

2. Morale

It has become increasingly obvious that modern employee engagement calls for more than ping-pong tables and free snacks in the office, due to COVID, the Great Resignation, and Quiet Quitting. The tools you give people can help them execute their jobs more effectively, reduce unneeded stress, and free up their time to concentrate on more rewarding, meaningful work, which will help them feel more important and fulfilled when they go home each day. It’s possible that automating accounts payable is not the first thing that comes to mind when considering how to create a culture that puts the needs of its employees first, but there is ample evidence that backs this claim.

According to studies, the most crucial factor in determining an employee’s job satisfaction is their ability to be intellectually stimulated. The majority of workers see the benefits of automation because it gives them more time to devote to tasks that are more important and intellectually challenging. As a result, AP employees won’t have to stress about doing pointless processing all day long. Employees have more time to concentrate on strategic, value-added work because manual duties have been eliminated. This helps the business as a whole, but it also gives each employee a chance to improve personally. Automating repetitive processes also lowers errors and stress for workers, which enhances their overall job satisfaction. Employing AP automation will result in happier, more effective workers for you.

3. Enhanced compliance control

Automation software can assist firms to streamline document handling for audits and compliance. You can easily find any purchase orders, receipts, or invoices that are pertinent to a given transaction by linking all of your communications and documents to the transaction they took place on when you automate your accounts payable workflow. Also made simpler are audits and compliance initiatives. Integral security and accountability tools can signal suspicious activity and aid in the fraud detection process.

Compliance guidelines are integrated into the system when AP processes are automated. This ensures complete transparency throughout the process, allowing for the detection and prevention of fraud and typical dangers. The system will alert you to things like duplicate invoices, extra costs, and illicit activities.

Integration of AP automation tools encourages risk mitigation. The ultimate objectives are to eliminate errors and automate all regular tasks like audits.

Businesses can handle taxes as efficiently as possible in several ways with the use of AP automation.

- Streamlines legal holds, disposition procedures, and regulatory and audit compliance through the management of document preservation standards.

- Reduces the possibility of missing or lost invoices, protecting the accuracy of records.

- Uses role-based access and user interface restrictions, sensitive and ad hoc access controls, and integrated records compliance to help protect sensitive data.

- Allows companies to quickly create bulk PDF files that contain the contracts and invoices that auditors have requested in PDF format.

- Gives auditors direct, view-only access to stored photos and data.

- Assists in the collection of tax documents through the use of supplier portals.

- Streamlines tax reporting.

You must maintain compliance with ever-stricter standards and laws through 2022 and beyond. This means that you must maintain the security of your vendor, employee, and customer data. Protecting your critical data is significantly simpler using AP automation software.

Spreadsheets are not secure. Anyone can access all of your private supplier information with only one exposed password. Email isn’t any better. Cybercrime has increased by 6,000% since the COVID-19 pandemic. All it takes for your system to be compromised is for a worker to click on the wrong link.

You can set up extra security elements for access while protecting your data in an encrypted system with AP automation. For purchases, you may include additional approval stages and dual-factor authorizations. Finance teams experience particular stress during audit time as they struggle to manually gather all the necessary papers and prepare them for audit. It is now simpler than ever to generate the essential papers for audits using an automated approach!

Automation of accounts payable lowers the chance of human error, enhancing audit readiness. Automation allows for proper categorization and easy access to documents and invoices, which cuts down on the time and stress associated with audit preparation. Automated workflows minimize the possibility of fraud or non-compliance by ensuring that the required approvals and documents are in place before payments are made. Finally, automating AP improves the system’s audit preparedness by streamlining the procedure and making it more organized and effective.

4. Cost reduction

Automation can lower the cost of billing, enabling your company to cut expenditures and boost profitability. You can reduce labor costs by automating the accounts payable process since your AP department can function more efficiently with fewer staff members. By cutting human costs, you’ll also save money on physical costs like postage, office supplies (if you go paperless), and extra costs associated with manual invoicing.

If your company wants to go green while saving money, you can remove printing, paper, and storage costs for physical copies. All of your documents will be digitized owing to AP automation.

Better productivity combined with less physical labor equals cost savings. For your business, automating the accounts payable operations can result in significant cost savings. Reconciliation, document printing and mailing, and manual data entry all consume time and money. These chores can be streamlined, finished more quickly, and more effectively using automation. Automating the processing of invoices can also aid in identifying mistakes and double payments, which can reduce spending. A more efficient accounts payable department is the end outcome. The cost of processing bills can be greatly reduced through AP automation, saving the company money as well as time and resources. By minimizing the quantity of data entry required during the process and by doing away with the costs associated with document storage, shipping, and invoice preparation, automation aids in reducing labor costs.

Better productivity while saving money on physical labor equals cost savings. For your business, automating the accounts payable operations can result in significant cost savings. Reconciliation, document printing and mailing, and manual data entry all consume time and money. These chores can be streamlined, finished more quickly, and more effectively using automation.

As the volume of invoices processed increases, these cost reductions increase. The reasoning is clear. You can save more money the more bills you process. The cost per invoice is the ideal metric to use when comparing an automated accounts payable process to a manual one to determine how much money may be saved. It is the most reliable and popular way to calculate savings.

Adopting a digital workflow and going paperless can save manual labor by lowering the cost per processed unit, resulting in significant amounts of savings for big businesses. Cost reduction and process streamlining of invoice receipt, validation, queries, approvals, reconciliation, settlements, and payments depend critically on automation. Your AP department will save money by automating invoice processing and payment.

5. Workforce allocation

AP automation can help immensely redirect those employees towards a more fulfilling, high-ROI activity that benefits the firm more significantly. The workforce of an institution can be reallocated towards other tasks in the finance team for coming up with innovation, creating smoother workflows, and solving current problems.

6. Reduction of human errors

The fact that people make mistakes is something that cannot be prevented. There will be some degree of human mistake, even if you only work with the finest employees. However, just because mistakes will inevitably be made by individuals doesn’t mean you shouldn’t make an effort to stop as many of them as you can. With the use of automation, you may take measures to minimize human error, guarantee more accurate data, and ensure that jobs and processes run without hiccups. Working on automating aspects of your business operations can help if your company needs assistance in managing levels of human error.

Manual payables systems are prone to mistakes that frequently result in bigger issues including double payments, incorrectly paid invoices, and invoices that aren’t paid at all.

Fewer manual errors reduce the need for multiple departments to spend time investigating problems and handling supplier complaints.

There are plenty of payable problems to go around, but these are some of the more common issues that businesses experience when using a manual payable system.

Duplicate Payments

One of the biggest problems businesses face is paying an invoice twice. But why is this such a common error? In most cases, it’s due to inconsistent data entry. Many times, a vendor or supplier will send an initial invoice with a shipment and send a follow-up invoice a few weeks later. If a duplicate invoice is entered a second time, it can accidentally be paid. This can be an issue if you have multiple invoices coming in from the same vendor.

Paying an Invoice Too Early

Sometimes in their haste to get an invoice out promptly, a vendor or supplier will send out an invoice once an order is processed. That’s fine on their end but can lead to a business paying an invoice before the product has been received. This can happen if an early payment discount is offered by the supplier, or it can result from an AP department that wants to pay invoices quickly. Either way, an invoice should never be paid until the product or service ordered has been satisfactorily delivered.

Data Entry Errors

The more you rely on staff to enter accounts payable information, the more likely it is that errors will occur. Small errors such as not capitalizing a letter or adding zeros to an invoice number can lead to duplicate payments while transposing numbers or eliminating a decimal point can lead to payments issued for the wrong amount. When entering invoice data manually, human error is inevitable.

Unauthorized Purchases

Have you ever received an invoice for goods or services and you have no idea who ordered it or why? If you use internal controls, this may not happen, but when rules are loosely enforced, unauthorized purchases will continue to plague your business.

Lost or Misplaced Invoices

From the moment it’s mailed, a paper invoice has many opportunities to become lost or misplaced. The receptionist or mailroom may deliver the invoice to the wrong employee’s desk. Or maybe it’s the right employee, but the invoice is inadvertently covered up by other papers.

Maybe it gets lost on the way to the approver, or maybe it was lost in the mail and never delivered at all.

Automate Your Finances with Synced in Minutes!

7. Collaboration

Expanding your business is a natural ambition, but there is a significant difficulty to keep things going smoothly. Documentation accumulates, procedures are put under stress, and project teams are feeling pressure. Overcoming these difficulties requires effective teamwork, which AP Automation fosters.

Accounts Collaboration is essential to payable departments, thus any observable increase in the culture of collaboration is welcomed. It’s not enough to simply approve the payment of bills; transparency must also be maintained in all areas of the business, including account reconciliation, the issuance of purchase orders, and the monitoring of deliveries, among other things.

Automation can put the spark of life back into your department by eliminating the most troublesome, time-consuming, and tedious tasks.

If clerks don’t have to spend hours on tasks they detest, they can concentrate their energies on the most important steps in the procedure. Teams can collaborate more efficiently because automation streamlines multiple operations into a single process.

Companies require strong cooperation between the procurement and invoice processing departments to maintain a positive vendor relationship. The majority of the time, lengthy invoicing investigations and delays impede a smooth working relationship with vendors. With an intelligent AP solution in place, organizations can boost their ability to make educated decisions while fostering supplier relationships through quicker invoice clearance, prompt payment, and improved compliance. Payments that consistently come on schedule and without a hitch can establish your company as a valued partner for many providers. When you require assistance, a good reputation can be a lifesaver.

A successful company must have several divisions and departments operating together like well-oiled cogs in a machine. If this is to be accomplished, effective communication is essential, especially when different knowledge and skill sets are dispersed throughout the business. This is never more true when it comes to planning.

The ability to exchange crucial information among decision-makers in a single, simple-to-use system is a key benefit of AP automation systems. As a result, information is shared in a clear and timely manner, keeping the AP department and other important areas informed.

8. Enhanced insights

Automation software generates data intelligence that manual cash flow cannot produce. It gathers information from your cash flow procedures and gives you an accurate understanding of what’s happening with your company’s cash cycle. By using precise information to inform your financial decisions, you may expand your business.

Accounts payable automation software solutions will provide your firm with thorough dashboards, information, and insights that can be used to boost productivity and make wise business decisions.

You’ll get a clear view of your payment cycle and be able to tell where invoices are in each phase, how long they’ve been there, and who you need to get in touch with to move the workflow along.

You can export this information after business cycles and use it with your reporting and analysis software to quickly and simply aggregate and evaluate all of your company’s AP data.

9. Greater availability/Time reallocation

Time reallocation might be the most significant benefit of all. The Accounts Payable team can now concentrate on vendor management, process enhancements, and higher value duties rather than manual data entry thanks to automation. There is also an automatic, electronic audit trail when it comes to the audit procedure. By doing this, compliance is maintained and time spent looking through files for physical documents is decreased. Your team will save hours with AP automation. We predict that a normal business takes up to 10 days to process an invoice; even “best-in-class” businesses can take up to three days.

Processing time can be cut in half by eliminating manual processes from the AP process, which includes all phases from invoice reception through payment. If the day were longer, consider what your team could accomplish. Your team of knowledgeable, skilled finance and accounting specialists may concentrate on high-value business operations and spend less time on laborious, repetitive, and mistake-prone manual tasks.

In the past, invoices would wait for approval on desks or in email inboxes. These delays are eliminated, and the approval process is streamlined, owing to automated routing. To ensure that the appropriate individual receives an invoice at the appropriate time with programmable reminders, specific criteria can be implemented in the workflow. Dashboards shorten the time it takes to find a status by providing users with a high-level, real-time view of invoice processing.

The amount of time required to process an invoice is decreased by using business process automation to manage accounts payable. Payables are automatically and instantly routed per the established business processes that you choose. By putting in place an AP automation system, no one in your company will ever again have to waste time looking for an invoice or trying to figure out where it is in the approvals process. Once you use AP automation software, an invoice will never again be “misplaced.”

What Makes AP Automation Worth it?

Automating AP makes sense for numerous reasons. Some of these include an immediate, measurable return on investment. AP automation can save your processing expenses by eliminating the need for manual labor. It can also make it easier for you to scale AP as your company expands by negating the need to add staff.

Additionally, AP automation offers solutions that can improve your control over payments and cash flow. Automation of AP can improve your potential to obtain supplier payment reductions by expediting and streamlining the payment process.

Less fraud, fewer mistakes, and easier audits are some additional benefits. Improved dashboards make it simpler to track staff productivity, which is helpful for employee evaluations. Managers can use the tool to monitor team and individual productivity.

AP automation software offers a clear look into the payment cycle with extensive dashboards. Where an invoice is located and who to contact in case of delays are both visible. Real-time access to data with the ability to import and export it makes it ideal for reporting and analysis, particularly near the close of business cycles.

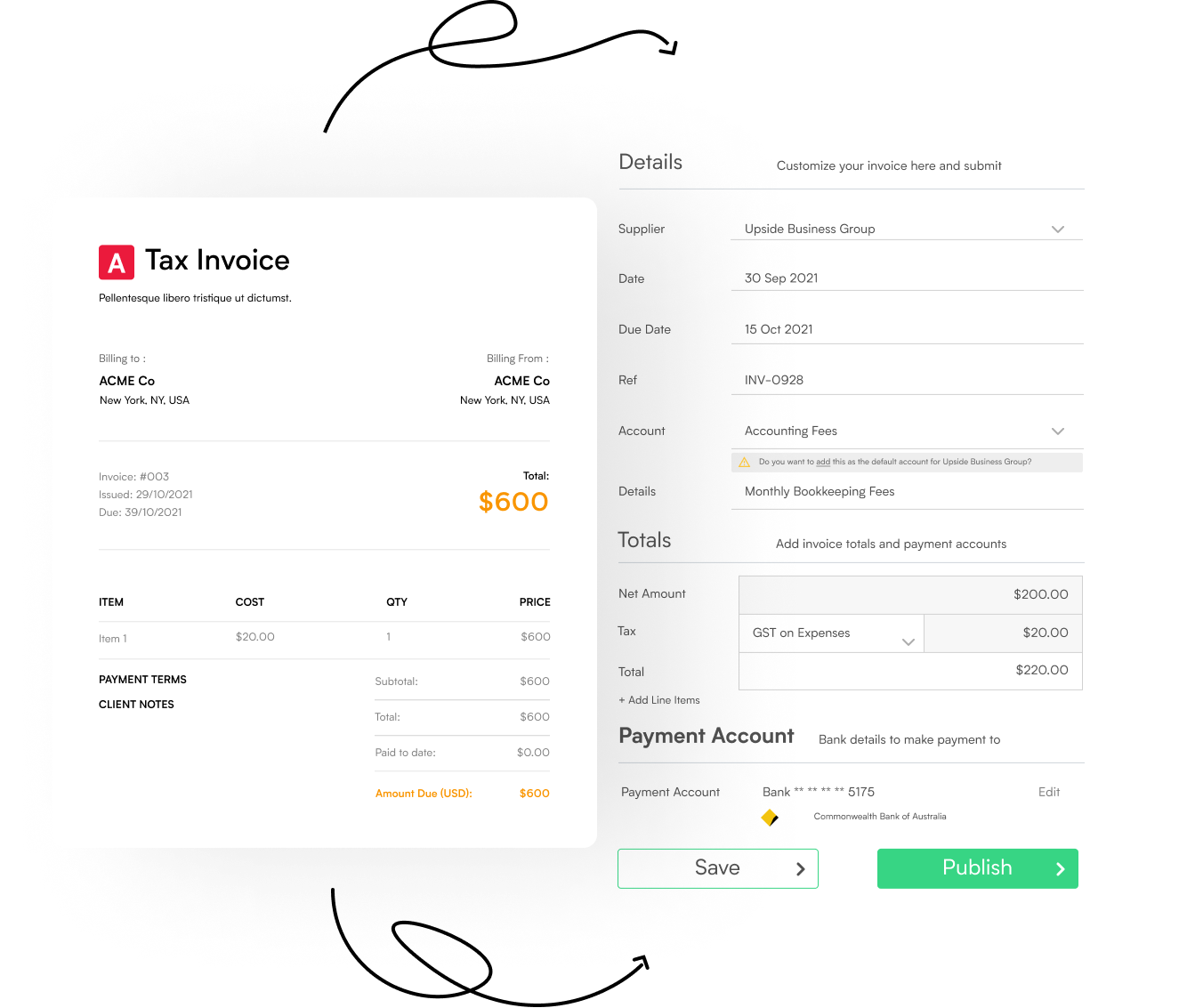

Why Choose Synced for AP Automation?

Synced leverages the power of AI to help you take control of your business processes. Synced is a single, customizable solution that allows businesses to manage their expenses – from purchase to payment. The Synced platform assists businesses to automate their accounts payable, bookkeeping, and compliance processes.

How it Works?

- Invoice Processing: Simply upload or email your invoices and our technology processes in seconds.

- Bill Approval: Embed approval workflows to ensure all spend is reviewed before payment.

- Supplier Payments: Pay on your terms, using the methods that you use in your business.

- Reporting: Get customized insights delivered on a schedule you define.

- Bookkeeping: Our 2-way synced with Xero & QBO ensure your books stay up to date.

- Taxes: Capture all your business expenses and maximize your deductions.

Take the stress out of managing all your business expenses. Simply forward your bills to Synced and our tech will take care of the rest.

Want To See Synced in Action?

Book a demo with one of our Synced experts and see how it can automate your workflows. Contact us at [email protected].

Let automation help your business soar!