Table of Content

What is Automated Accounting?

Automated accounting involves the use of software to automate crucial finance operations. Accounting software enables the automated completion of tasks including account reconciliation, financial data updating, and financial statement preparation.

Accounting automation is a kind of software that streamlines the accounting process by automating the most labor-intensive operations. These programs, which are also known as automated accounting software or computerized accounting systems, are a crucial element of the procedures used by the accounting team. Although computerized accounting is not a new concept, recent advancements in robotic process automation (RPA) and artificial intelligence have greatly increased the capabilities of these systems. Accounting software may use AI to do all tasks, including tracking and recording data. Data entry and computation procedures are eliminated thanks to AI, freeing up analysts to work on more important activities.

The entire accounting process can be reimagined with the use of automation tools. Modern solutions are error-free and require little human input to finish tasks. It allows members of your team to focus on more strategic activities like planning investments or budgets.

Importance of Account Management for Every Organization

The goal of account management is to establish a comprehensive relationship between your company and the client, nurture that relationship, and add value for the client. proving your commitment to meeting their needs and that you, as a firm, have their best interests in mind.

The effective deployment of account management enhances the value of a first transaction that was primarily motivated by price. In addition to offering a high-quality service or product, it enables you to build a solid, strong, and long-lasting relationship. encouraging client satisfaction and, more importantly, customer loyalty.

In today’s market, repeat customers are more profitable than new clients, therefore long-term business success depends on enhancing customer retention and providing great customer experiences. Long-term customers are more likely to increase their purchases over time and recommend your company to others, which lowers operational costs (such as prospecting and lead nurturing).

Accounting with Technology

Advancements in technology are transforming the way accounting has been traditionally done. Part of the reason for the accounting industry’s rapid transformation is the productivity enhancement provided by more modern technologies. Task-oriented projects are no longer a burden for the accountant of today. Instead, the job of the accountant is shifting to that of a business advisor as a result of the change in dynamic accounting technology, which has resulted in more automated accounting software packages.

One of the fast-emerging trends in accounting departments across the board is the increasing use of automation technology. Accounting technology is the conversion of formerly paper-based systems and processes into efficient accounting workflow solutions that are available around the clock via cloud-based software. In the not-too-distant past, accountants devoted a significant portion of their day to producing financial statements or entering trial balance data into engagement software.

Technology today has a favorable effect on accounting organizations. Accounting technology and cloud-based platforms are being used by businesses for automation, sophisticated diagnostics, and predictive analysis to better serve customers and make better use of their expertise.

Automate Your Finances with Synced in Minutes!

Benefits of Integrated Tools

All types of modern organizations utilize a wide range of applications to satisfy their demands. However, these systems aren’t always integrated, forcing employees to shift data manually. Integrating these many systems is the obvious solution. Here are 10 advantages of data integration to motivate action:

1. Better Data Access

If your company employs multiple systems, you will need to handle multiple data silos as a result (and that puts you at a huge disadvantage). Finding information and documentation turns out to become a time-consuming nightmare. These data silos are combined through system integration, improving your access to your data.

2. Real-Time Data

You cannot obtain real-time reporting without connected data streams. Instead, you usually need to give personnel at least a day to run and compile reports. You are thereby forced into a reactive rather than a proactive position.

The days of feeling in the dark about your company’s success are long gone. Real-time data flow from integrated systems onto a single data dashboard allows quick reporting and data interpretation.

3. Comprehensive Customer View

The only way to have a single customer view throughout your company is to remove bad and duplicate data. With linked systems, you can eliminate unnecessary data points and obtain a more accurate picture of your customers.

4. More Sales

You can better meet the demands of your consumers if you have a clearer picture of them and comprehensive reporting. You’ll be in a better position to meet your consumers’ expectations, whether it is through more interaction, cross-selling of services, or more precise promotions.

5. Save Time and Money

The bane of any employee’s existence is manual data entry. Nobody likes staring at spreadsheets as they wait for the data to fill in and getting blamed for mistakes made during manual data entry. It’s unpleasant.

Integrated solutions eliminate the need for these tedious chores, freeing up your employees’ time to concentrate on crucial things. The best part is that you’ll need fewer workers to handle these duties. In other words, you won’t overwork your team while maintaining a lean, scalable business.

6. Improved Work Culture

Burnout occurs when workers believe they must labor harder and harder to make any significant progress. They struggle to find time to focus on complex work as mindless chores like manual data input and document searching pile up. If this continues for a while, your staff members will lose interest and quit. After all, one of the primary causes of employee departure is due to inefficient systems.

Your systems’ integration will lessen the work strain on your personnel (and turnover). They won’t feel as pressured. They’ll have more time to devote to activities that can help your company flourish as a result. Their work will feel more meaningful as a result, and the workplace culture will also enhance.

7. Avoid Costly IT Expenses

Legacy systems are a source of contention. However, replacing them is frequently expensive, and teaching new hires how to use new systems takes time. Integrations assist you in extending the life of your legacy systems if you are currently bound to them.

You can keep up with market changes and consumer needs with the functionality you need to be competitive by integrating new applications into your existing systems. (Without becoming bankrupt.)

8. Data Foresight

Integrated systems produce cleaner data. Additionally, enhanced data forecasting is made possible by cleaner data. You will be able to make better forecasts with connected applications, giving you the advantage and setting up your company for long-term success.

9. Decreased Bottlenecks

Slowdowns are exacerbated by inefficient systems. The ability of a large organization to operate swiftly with dispersed systems is substantially diminished by communication lags and siloed data.

These bottlenecks are eliminated through integrated systems, which also lessen the need for pointless back and forth. As a result, your entire organization operates more efficiently.

10. Enhanced Data Security

Spreadsheets lack security. All of your client data is accessible to anyone who knows the password, even if it is password-protected. A significant data breach can occur as quickly as one lost email or one person clicking the wrong link.

Spreadsheets are no longer required to collect data because of integrated systems. Your private data is instead gathered and stored in a secure database.

Integration of Data is Important

Integrating tools is necessary because you need reliable, real-time data sets to compete in the digital age, and data integration is important. Anything less forces you to make decisions based solely on instinct and whim.

Neither results in consistent, sustainable corporate success.

Instead, you will have a deeper understanding of your client, prospect, and the changing digital world due to the advantages of data integration. You can therefore make substantial choices that increase your success and expand your company.

The best part is that you’ll protect consumer data, lowering unneeded dangers to your company. Additionally, you’ll eliminate monotonous data entry duties from your company, saving time and money while significantly enhancing the work environment.

Automate Your Finances with Synced in Minutes!

Disadvantages of Manual Accounting

Some organizations still choose to handle their accounts by hand, in an old-fashioned manner. However, while this may have been a viable choice in the past, it is no longer realistic in the modern world.

There are several serious disadvantages to managing your accounting procedures by hand that could wind up costing your company time and money.

Your company’s accounts payable (AP) department is crucial. Except for payroll, it handles all of your bills, supplier invoices, loans, and other payables. However, if you still use a manual accounting system, your firm may be suffering unanticipated but major consequences as a result of the inefficiencies of your procedures, like missed payments, late penalties, interest charges, poor credit ratings, and lost suppliers.

We’ll talk about the drawbacks of manual accounting and why you should avoid it at all costs.

1. Prone to human error due to manual data entry

Being subject to human error is one of the major risks of manual accounting. There are numerous mistakes that can be made, ranging from straightforward math errors to more complex ones like misclassifying transactions. And when it comes to your money, even a tiny error can have significant repercussions. The last thing you want is for your financial reports to contain inaccuracies that could have been avoided.

2. Inefficient process

Because your AP team is still tracking invoices manually, you most likely have a lengthy and complicated payment processing system. This might lead to late payments and disgruntled suppliers. You risk having your account suspended or paying a hefty interest rate. It may also negatively affect your credit score and professional standing.

Additionally, an ineffective manual process can place a lot of strain on the accounts payable team members, resulting in dissatisfied workers and poor outcomes. Each invoice processing takes longer, and data entry into the system by hand requires extra caution. They probably prefer to be engaged in more strategic projects. Have you ever calculated the exact cost of manually processing invoices? You might be amazed at how quickly it can accumulate when you consider how much time each employee spends and factor in their salaries.

3. Time-consuming

Another drawback of manual accounting is how time-consuming it is. The procedure can consume a significant amount of your time, time that would be better spent on duties that help your organization expand, from data entry to accounting reconciliation. Your team’s capacity to work on other tasks suffers when they spend hours each week on accounting.

4. Lack of real-time insights

Manual accounting also has the drawback of not providing you with real-time financial information about your company. You can only obtain a picture of your money at a given time if you rely solely on handwritten reports. Because of this, it could be challenging to identify trends or problems early on and make the required adjustments to keep your firm on course. This also affects your ability to make decisions because you don’t have access to the latest facts.

5. Inability to manage information

The AP team reviews numerous bills, invoices, records, and other pieces of data. It can be difficult and daunting to manage and keep track of everything, especially if your accounting system is manual. Where do you keep all of the data? How can you quickly access a particular document?

Papers and other tangible documents that need to be filed and stored can take up a lot of room and increase ongoing storage costs. Additionally, you must consider how everything will be organized for simple access and tracking. Consider how difficult an audit is when nothing is found!

6. Lack of overall visibility and control

The loss of visibility and control is a significant obstacle as well as possibly the most painful one. It can be very challenging to monitor the status of payments when you are dealing with paper invoices and actual AP documentation. At each step of the process, from data entry and logging to scheduling and actual payment, this necessitates continuous manual monitoring and checking. The number of bills and invoices you receive each month will determine how quickly things spiral out of control.

7. Difficulty scaling

Your requirement to track and handle a growing volume of data rises along with your organization. Manual accounting can only be scaled so far before it becomes unworkable. It will get harder and harder to meet the demand utilizing manual methods as your team grows and your transaction volume rises. You’ll eventually need to automate your accounting procedures in order to keep up with your company’s expansion.

8. Vulnerability to fraud

Using a manual accounts payable system has a knock-on effect in that it exposes your business to security flaws and fraud because there is a lack of visibility and control over these processes. The accounts payable department handles very sensitive data, and it can be challenging to spot any unusual activity without the safeguards and fraud protection provided by an automated system.

9. Difficult to track changes

The inability to trace changes in manual accounting is another drawback. Finding the proper document and determining what was altered and when can take some time if you need to check back and review a previous transaction. This is particularly problematic if you need to identify where a mistake came from. Manually accomplishing this can be quite challenging, but automated accounting solutions track and log all changes, allowing you to quickly determine who made what changes and when.

10. Missed opportunities

If your accounting procedures are manual, you risk missing out on possibilities to profit from available tax breaks and other advantages. It’s simple to overlook potential deductions or forget to take advantage of early payment savings since your system isn’t automated. In the long run, this could end up costing a lot of money to your company.

11. Inaccurate data

Manual accounting also has the drawback of perhaps producing erroneous data. There is a higher likelihood of errors while manually entering data. Additionally, depending on paper documents increases the risk of their loss or damage, which can result in corrupted or deleted data. It can be challenging to make wise financial judgments when your data is inaccurate since it might mess up your entire accounting system.

12. Limited reporting capabilities

Another disadvantage of manual accounting is its restricted reporting capabilities. When you manually create reports, you can only include the data that is currently in your possession. This can make it challenging to acquire a clear picture of your company’s finances and make wise resource allocation choices. On the other side, automated accounting systems provide you access to a wealth of data and let you create unique reports that can aid you in making better business decisions.

It’s time to switch to an automated solution if you’re still using manual processes. It will not only help you save time and money, but it will also give you real-time financial data that will allow you to make smarter decisions and keep your company on track.

Synced: One-Stop Solution for All the Finance-Related Problems

Synced harnesses the power of Artificial Intelligence to help you take charge of your business processes. Synced is a single, customized solution for businesses to manage their spending, from purchase to payment. The Synced platform helps companies automate their compliance, bookkeeping, and accounts payable procedures.

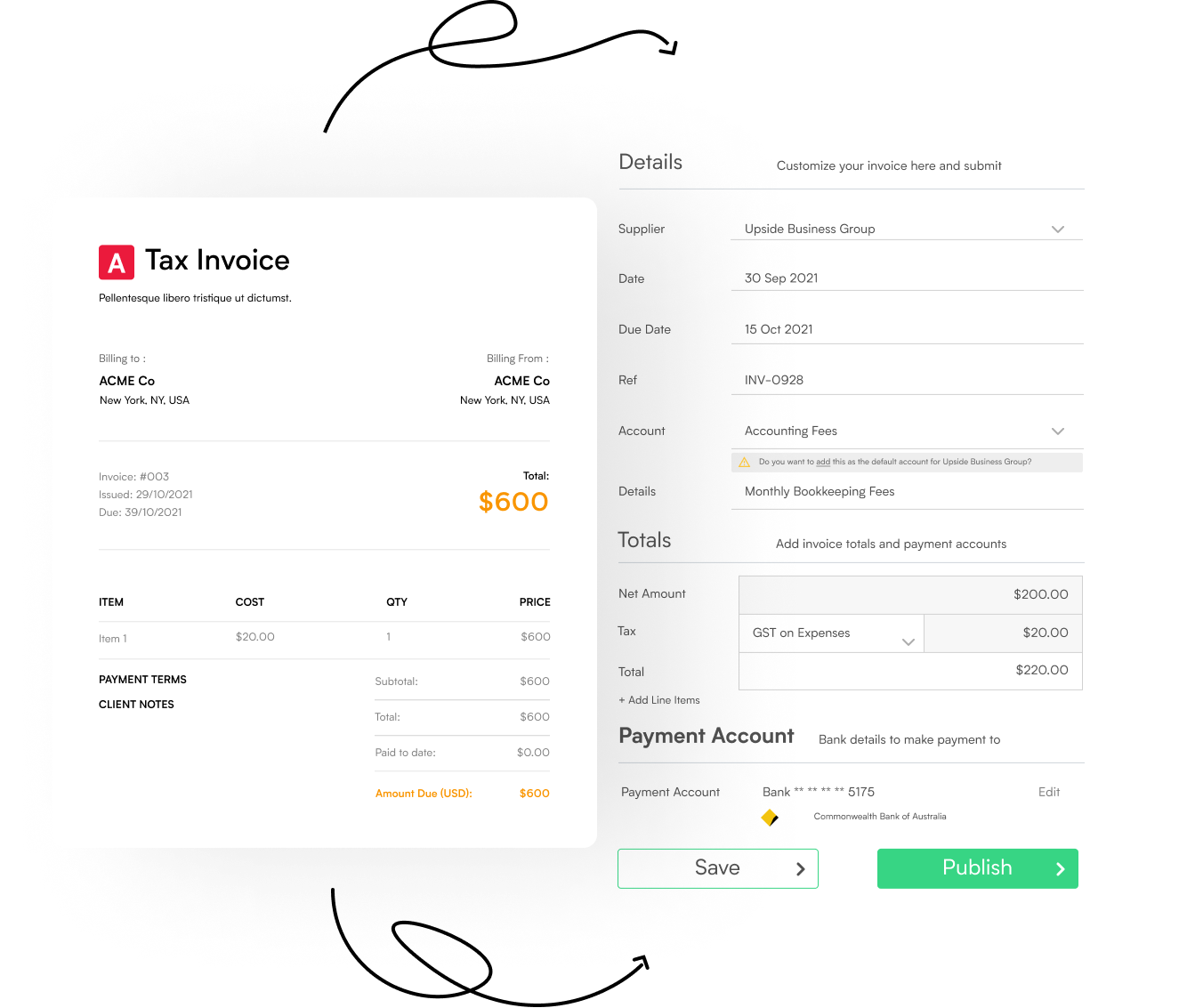

How it Works

- Invoice processing: Simply upload or email your invoices and our technology processes in seconds.

- Bill approval: Embed approval workflows to ensure all spend is reviewed before payment.

- Supplier payments: Pay on your terms, using the methods that you use in your business.

- Reporting: Get customized insights delivered on a schedule you define.

- Bookkeeping: Our 2-way synced with Xero & QBO ensure your books stay up to date.

- Taxes: Capture all your business expenses and maximize your deductions.

Take the stress out of managing all your business expenses. Simply forward your bills to Synced and our tech will take care of the rest.

Want To See Synced in Action? Book a demo with one of our Synced experts and see how it can automate your workflows. Contact us at [email protected].

Let automation help your business soar.