Table of Content

What is Finance Automation?

Finance automation is the process of using technology and software to automate financial processes and tasks. It has become an essential aspect of modern businesses as it streamlines financial operations and provides numerous benefits.

The major benefits of finance automation are:

1. Increased efficiency

One of the most significant benefits of finance automation is increased efficiency. With finance automation, manual and repetitive financial tasks can be automated, reducing the time and effort required to complete them. This can free up your finance team to focus on more strategic tasks and reduce the risk of errors.

2. Improved accuracy

Finance automation can improve accuracy by reducing the risk of human error. Automated systems can perform complex calculations and generate reports more accurately and quickly than humans. It also eliminates the risk of manual data entry errors and ensures that all financial data is consistent and up-to-date.

3. Cost savings

Finance automation can lead to significant cost savings for businesses. Automating financial tasks can reduce the need for manual labor, which can save businesses money on staffing costs. It also reduces the risk of errors, which can result in costly mistakes.

4. Better cash flow management

Cash flow management is crucial for businesses of all sizes. Finance automation can help businesses manage their cash flow more effectively by automating tasks such as invoicing and payment processing. This can improve the accuracy and timeliness of payments, which can help businesses maintain healthy cash flow.

5. Improved decision-making

Finance automation can provide businesses with real-time financial data, enabling them to make informed decisions quickly. Automated systems can generate reports on financial performance, allowing businesses to identify trends and make strategic decisions based on data.

6. Increased security

Finance automation can improve the security of financial data. Automated systems can store financial data securely, reducing the risk of data breaches and fraud. It also ensures that financial data is only accessible to authorized personnel.

Finance automation provides numerous benefits for businesses of all sizes. It increases efficiency, accuracy, and cost savings, improves cash flow management, enables better decision-making, and increases security. With the many benefits that finance automation provides, it is clear that businesses that adopt it will have a significant advantage over those that don’t.

Automating Your Way to Efficiency

Streamline your workflow by automating these six time-consuming tasks

In today’s fast-paced business environment, time is a precious commodity. As a business owner, you know there are only so many hours in a day, and you need to make the most of them. Automating certain time-consuming tasks can help you create ease in your business operations, increase productivity, and reduce the risk of errors. In this blog, we’ll discuss six time-consuming tasks that can be automated to create ease.

1. Core Bookkeeping

Bookkeeping is the process of recording and tracking all financial transactions in a business. It’s an essential task that helps you keep track of your business’s financial health, but it can be time-consuming and tedious. Automating your bookkeeping tasks can save you a lot of time and effort. There are several bookkeeping software programs available in the market that can help you automate this process. These software programs can help you with tasks such as recording transactions, reconciling bank statements, generating financial reports, and more.

2. Invoicing and Accounts Receivable

Invoicing and accounts receivable are essential tasks that help you get paid for the products or services you provide. However, these tasks can be time-consuming, especially if you have a large number of clients. Automating these tasks can help you streamline your invoicing and accounts receivable processes, saving you time and effort. You can use software programs to create and send invoices automatically, track payments, and generate reports.

3. Accounts Payable

Accounts payable is the process of managing your business’s expenses and paying your bills. This task can be time-consuming, especially if you have a large number of vendors and bills to pay. Automating your accounts payable process can help you save time and reduce the risk of errors. You can use software programs to track expenses, automate bill payments, and generate reports.

4. Tax Compliance and Reporting

Tax compliance and reporting are essential tasks that every business must undertake. However, these tasks can be time-consuming and complex, especially if you’re not familiar with tax laws and regulations. Automating your tax compliance and reporting tasks can help you save time and ensure that you comply with all tax laws and regulations. You can use software programs to calculate and file your taxes, track deductions, and generate tax reports.

5. Payroll

Payroll is the process of managing your employees’ salaries, benefits, and taxes. It’s a critical task that ensures your employees are paid accurately and on time. However, this task can be time-consuming, especially if you have a large number of employees. Automating your payroll process can help you save time and reduce the risk of errors. You can use software programs to calculate and process employee salaries, track benefits, and generate payroll reports.

6. Expense Management

Expense management is the process of managing your business’s expenses, including travel expenses, office supplies, and other expenses. It’s an essential task that helps you keep track of your business’s expenses and ensure that you’re staying within your budget. Automating your expense management process can help you save time and reduce the risk of errors. You can use software programs to track your expenses, automate expense approvals, and generate expense reports.

Automating time-consuming tasks can help you create ease in your business operations and increase productivity. By automating tasks such as core bookkeeping, invoicing and accounts receivable, accounts payable, tax compliance and reporting, payroll, and expense management, you can save time, reduce the risk of errors, and focus on growing your business. Investing in software programs that can help you automate these tasks and take your business to the next level.

Automate Your Finances with Synced in Minutes!

How Outsourcing can Boost your Finance Team’s Performance and Efficiency?

Outsourcing is the process of delegating certain business tasks to external service providers rather than completing them in-house. One of the most commonly outsourced functions is finance, which includes accounting, bookkeeping, payroll, tax preparation, and financial reporting. Outsourcing finance tasks can benefit businesses of all sizes, particularly when it comes to optimizing the use of the finance team. In this blog, we will discuss the benefits of outsourcing for the optimal use of the finance team.

1. Increased efficiency and productivity

Outsourcing finance tasks frees up the finance team’s time to focus on higher-value activities that contribute to the business’s growth and success. Instead of spending hours on routine bookkeeping and accounting tasks, the finance team can devote their expertise to analyzing financial data, developing financial strategies, and identifying areas for cost savings and revenue growth.

2. Access to specialized expertise

Outsourcing finance tasks allows businesses to access specialized expertise that may not be available in-house. External service providers have the necessary expertise, technology, and resources to handle complex financial tasks, such as tax preparation and financial reporting, with greater efficiency and accuracy. This ensures that businesses comply with the latest regulations and accounting standards and minimize the risk of financial errors or fraud.

3. Cost savings

Outsourcing finance tasks can significantly reduce the cost of maintaining an in-house finance team. By outsourcing, businesses can avoid the expenses associated with recruiting, training, and retaining finance staff, as well as the costs of software and hardware upgrades, office space, and benefits. Additionally, outsourcing finance tasks allows businesses to pay only for the services they need, without the burden of fixed overhead costs.

4. Improved scalability and flexibility

Outsourcing finance tasks allows businesses to easily scale up or down their financial operations to meet changing business needs. This flexibility enables businesses to respond quickly to market changes, expansion opportunities, or cost-cutting measures without the constraints of an in-house finance team.

5. Reduced risk and increased compliance

Outsourcing finance tasks can help businesses reduce the risk of financial errors, fraud, or non-compliance with tax laws and regulations. External service providers have the expertise to identify and address potential risks and ensure that businesses comply with the latest accounting standards and regulations.

In conclusion, outsourcing finance tasks can offer significant benefits for businesses of all sizes. It can help optimize the use of the finance team by increasing efficiency, providing access to specialized expertise, reducing costs, improving scalability and flexibility, reducing risk, and increasing compliance. By outsourcing finance tasks, businesses can focus on their core competencies and achieve their strategic goals more effectively.

Maximizing Efficiency: Essential Features for Financial Automation Software

With so many financial automation software options available in the market, choosing the right one can be challenging. Here are some essential features to look for in your financial automation software.

1. Robust Security Features

When it comes to financial data, security is of paramount importance. Therefore, businesses must choose financial automation software that offers robust security features. This includes data encryption, secure data storage, and multi-factor authentication. Businesses should also ensure that the software complies with regulatory requirements.

2. Intuitive Interface

A user-friendly and intuitive interface is essential for successful financial automation. The software should be easy to navigate and provide a clear overview of financial processes. The interface should also allow users to customize dashboards and reports to meet their specific needs.

3. Scalability

As businesses grow, their financial automation needs also increase. Therefore, it is crucial to choose financial automation software that is scalable and can handle an increase in data volume and complexity. The software should also allow businesses to add new functionalities and modules as needed.

4. Integration Capabilities

Integration capabilities are critical for financial automation software. The software should be able to integrate with other tools, such as accounting software, payment gateways, or budgeting tools. This enables businesses to share information quickly and easily and ensures data accuracy and consistency.

5. Workflow Automation

Workflow automation is a critical feature of financial automation software. It enables businesses to automate routine tasks, such as invoice processing, payment approvals, and financial reporting. This saves time, reduces manual errors, and frees up resources for more strategic activities.

6. Analytics and Reporting

Financial automation software should provide robust analytics and reporting capabilities. This allows businesses to track key financial metrics, identify trends, and make data-driven decisions. The software should also allow users to create customized reports and dashboards to meet their specific needs.

7. Support and Training

Finally, businesses should choose financial automation software that offers excellent customer support and training. This ensures that users can maximize the software’s potential and troubleshoot any issues that arise quickly.

Choosing the right financial automation software is essential for successful financial management. By looking for software with robust security features, an intuitive interface, scalability, integration capabilities, workflow automation, analytics and reporting, and excellent support and training, businesses can make informed decisions and achieve their financial goals.

How Synced can Help You with Automating these Tasks?

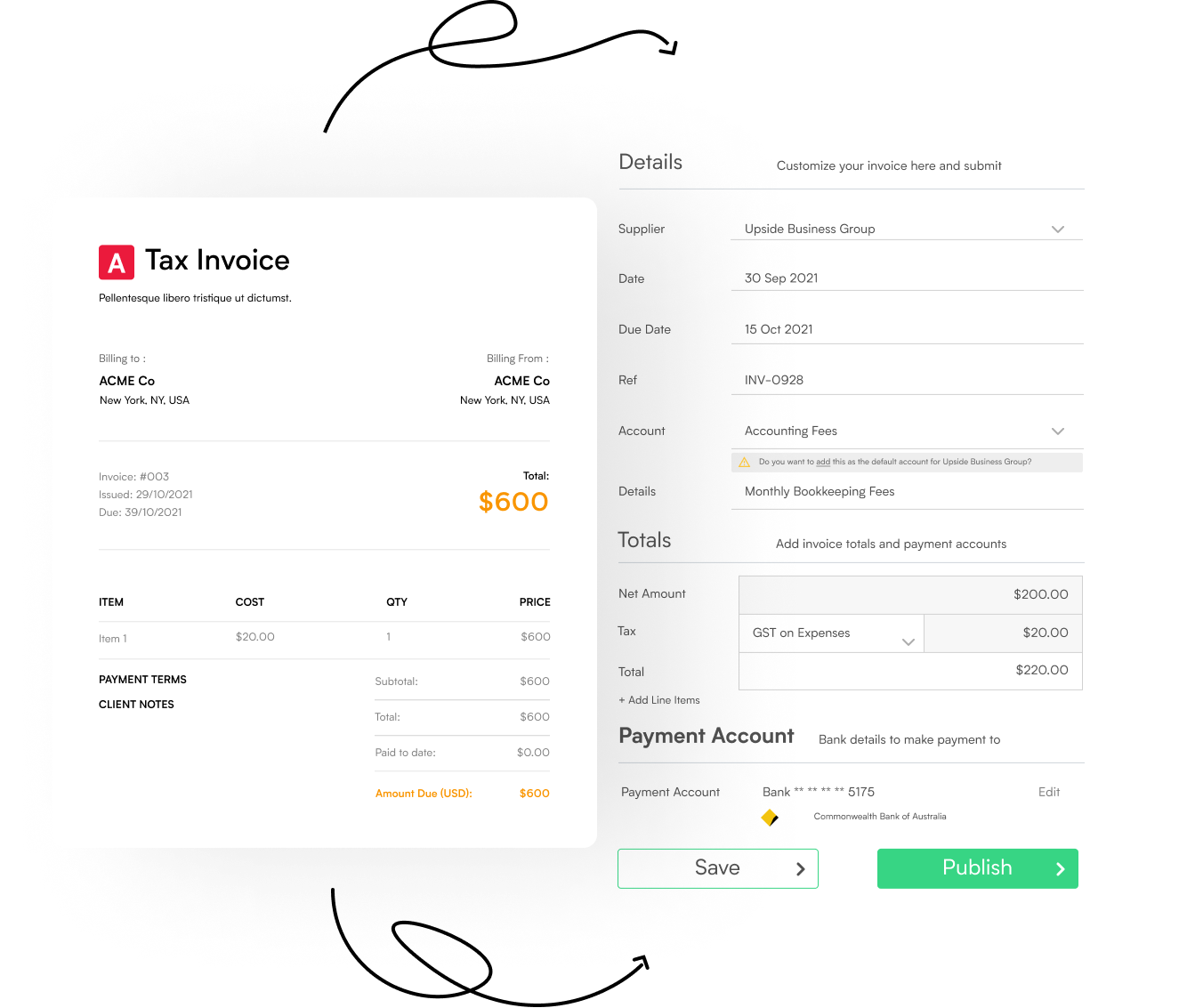

Synced leverages the power of AI to help you take control of your business processes. Synced is a single, customizable solution that allows businesses to manage their expenses – from purchase to payment. The Synced platform assists businesses to automate their accounts payable, bookkeeping, and compliance processes.

Synced will help you with:

- Manage Cashflow: Our payment scheduling solutions allow businesses to pay suppliers with the confidence of knowing there is sufficient cash flow in the business.

- Eliminate Data Entry: Stop wasting time manually copying data from an invoice. Leverage the power of AI to extract the required information and publish it to your accounting software. With 99.7% accuracy, Synced’s smart tech allows users to save time and reduce human errors

- From Purchase to Pay: In addition to key invoice information, our tech also extracts and securely stores supplier banking information. This means that bills can be processed & scheduled for payment in one seamless workflow.

- Advanced-Data Extraction: Our technology extracts supplier invoice information (due date, amount, tax) as well as information such as payment account details, job codes, and more

- Always Up To Date: Transactions recorded in Synced are sent to your accounting software in real time, ensuring your financial data is always up to date.

Automate Your Finances with Synced in Minutes!

How Synced can Benefit Your Business

Synced as a platform can benefit your business in numerous ways. Try out Synced in your business and boast of unprecedented efficiency. Synced works in the following ways:

- Invoice processing: Simply upload or email your invoices and our technology processes in seconds.

- Bill approval: Embed approval workflows to ensure all spend is reviewed before payment.

- Supplier payments: Pay on your terms, using the methods that you use in your business.

- Reporting: Get customized insights delivered on a schedule you define.

- Bookkeeping: Our 2-way synced with Xero & QBO ensure your books stay up to date.

- Taxes: Capture all your business expenses and maximize your deductions.

Send documents to your finance teams in real-time via and collaborate in one place on any missing paperwork. Take the stress out of managing all your business expenses. Synced was developed by financial experts. We are always on hand to support your business.

Simply forward your bills to Synced and our tech will take care of the rest.

Want To See Synced in Action? Book a demo with one of our Synced experts and see how it can automate your workflows. Contact us at [email protected]. Synced is designed to scale your business as it grows. Synced automation software is the one-stop solution for your expense-related problems. Let Synced help your business thrive!