Table of Content

As businesses grow, so do their expenses. With the increase in the number of transactions, it becomes harder to keep track of every expense and to process them in a timely and efficient manner. Manual processing of expenses is time-consuming and prone to errors. This is where OCR (Optical Character Recognition) comes into play. OCR is a technology that allows you to convert scanned documents into digital format, making it easier to process, store, and retrieve information. In this blog article, we will discuss how to automate expense processing using OCR.

Step 1: Gather your Expenses

The first step in automating your expense processing using OCR is to gather all your expenses in one place. This can include receipts, invoices, bills, and any other financial documents related to your business expenses.

Step 2: Scan your Documents

Once you have gathered your documents, the next step is to scan them. You can use a scanner or a smartphone app to scan your documents. Make sure to scan them in high resolution and in a format that can be easily recognized by OCR software.

Step 3: Use OCR software

Once you have scanned your documents, you can use OCR software to extract the data from them. OCR software uses algorithms to recognize text from scanned images and convert it into a digital format. There are many OCR software options available in the market, such as Synced.

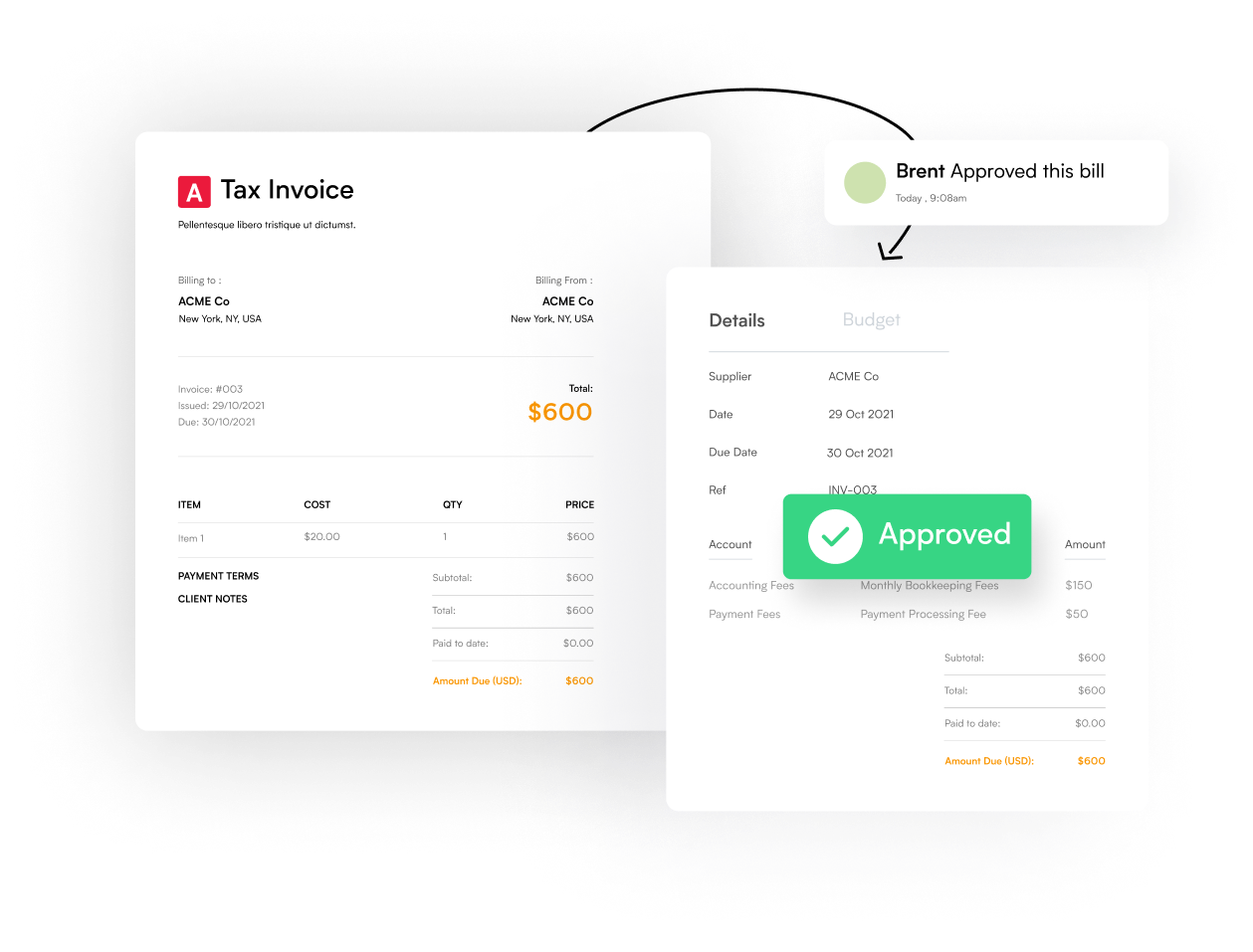

Step 4: Check and Validate the Extracted Data

After extracting the data from your scanned documents, it is important to check and validate the data. OCR software is not always 100% accurate, and there may be errors in the extracted data. Make sure to double-check the extracted data against the original documents to ensure accuracy.

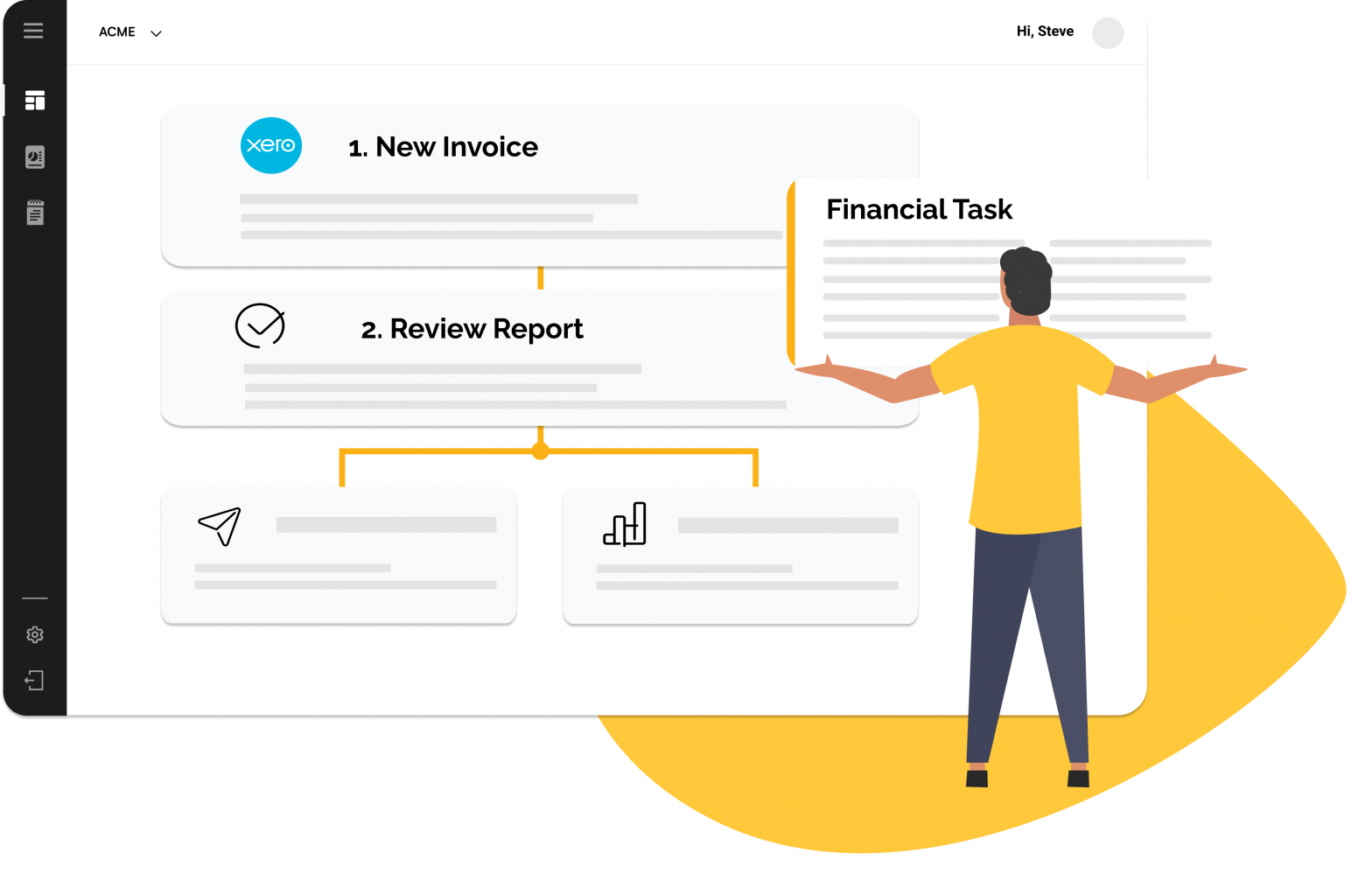

Step 5: Integrate with your Accounting Software

The final step in automating your expense processing using OCR is to integrate the extracted data with your accounting software. Expenses automation such as Synced provide direct integration with accounting software such as Xero and QBO.

Automate Your Finances with Synced in Minutes!

Benefits of Automating Expense Processing using OCR

Automating your expense processing using OCR has many benefits, such as:

- Saves time: OCR automates the manual data entry process, saving you time and allowing you to focus on more important tasks.

- Increases accuracy: OCR software is more accurate than manual data entry, reducing the risk of errors in your financial data.

- Improves productivity: Automating your expense processing using OCR can significantly improve your productivity and efficiency.

- Saves money: Automating your expense processing using OCR can help you save money by reducing the need for manual data entry and increasing accuracy.

Conclusion

Automating your expense processing using OCR can help you save time, increase accuracy, improve productivity, and save money. By following the steps outlined in this article, you can easily automate your expense processing using OCR and streamline your business operations.