Table of Content

Expense automation software is a centralized, digital environment that assists organizations in automating the manual aspects of the accounts payable workflow, primarily invoice management, approvals, and payments.

Leveraging technology to streamline the expenditure management process—recording, monitoring, approving, and paying for reimbursable employee expenses—is known as expense management automation. The system uses expense management software to process reimbursement requests quickly and with little manual data entry.

With automation capabilities, software effectively gives your clerks a boost, ensuring increased data accuracy, quicker processing, and better teamwork opportunities.

Why Should You Use Expense Automation Software?

An expense management system helps your finance team monitor and regulate when and how money leaves the firm. Without this system, managing spending could be challenging. Procedures for filing, confirming, approving, and paying expense reimbursements should be covered by the process.

The time, energy, and resources required for a traditional or manual expense management procedure are enormous. In contrast, an automated expense management system efficiently organizes your company’s finances.

An expense automation tool also has oversight and control over employee spending, which provides precise cash flow statistics for improved forecasting and financial planning.

In other words, the benefits of investing in an expense management system that is more effective can include time, money, and effort savings. The annual cost of human error and manual reporting adds up to a staggering amount of money that could be used for other business improvements and lost time that employees could be spending on tasks such as strategizing, planning, and expanding the firm.

Features of Expense Automation Software

The features of expenditure management software vary depending on the vendor. Nonetheless, the most crucial ones are:

Real-time visibility into spending

An intuitive interface with up-to-date expenditure data, including history, is required for automated cost management software. This data is quite valuable to overview normal and one-time spending and generate actionable insights from that.

This feature also has

- Spend patterns, insights, and anomalies in the form of data or graphs.

- Expenses that are categorized based on time, vendor, department, expense category, etc.

- Current balance availability.

- List of expenses and their details.

Easy expense reporting process

Expense reporting is the process of collecting the company expenses of employees in one place. Because the employer is required to reimburse these expenses, the software assists the claim process by collecting forms and processing them.

This feature includes:

- Digital claim forms that are simple to use and accept receipts.

- Automated workflows for approval and notifications to approvers.

- Employees can track their status in real-time.

- Analysis of department-based spending to cut back on wasteful spending.

Integration with preferred accounting software

Every company employs a different accounting software for reconciliation and other accounting needs. Their automated spending management software can be linked to other accounting apps if it has an open application interface. This integration enables them to communicate and share data. The sync automatically sends the data rather than requiring a human to do so. As a result, the expense software needs to offer an integration option for the majority of popular accounting software.

Enforce policy in real-time

Preventing expense fraud is one of the most important reasons to use cost management software. The cumbersome, error-prone element is eliminated with automated cost reporting. Workers are not required to preserve receipts, and budget managers are not concerned about information being fabricated or interpreted incorrectly. Also, good expenditure management systems can identify when vendors try to overcharge you or if your data is compromised.

Ensure compliance

Since the dangers of noncompliance could result in fines and harm to both your bottom line and your brand, compliance is usually high on the agenda for many businesses. It can be expensive and time-consuming to stay informed of new legislation and manage all the relevant modifications. The challenge increases in size and complexity when your company conducts business internationally. An audit might be disastrous and unachievable.

The risks associated with regulatory compliance are virtually eliminated by automated cost management solutions. They have built-in auditing capabilities and can apply complicated tax rules. Some take things a step further by collecting the information needed for filing corporate and income tax returns.

Advanced data analytics

One of the benefits of spending management software is its ability to manipulate data and provide an analytical perspective. Finance teams may surely benefit from these data-driven insights in understanding their past, present, and future financial situations. Expense management offers insight for intelligent business decisions and goes well beyond budget accounting. Reporting on a variety of performance measures is made easier by centralizing spending information. Increased employee adoption and an improved perception of where spending actually goes in real-time are both influenced by ease of use. It may do a variety of tasks, including:

- Indicators of fraudulent activity.

- Notice of policy violations and employee monitoring.

- Forecasting and planning for the budget.

- Displaying spending trends.

- Creation of financial reports.

Simplified expense approval

An essential function of cost management software is expense approval. Custom workflows provide the option to set up various expense types. There should be an option to select single to multi-level approvers. The software must automatically route to the desired approver based on the raised bill. This entire procedure should be straightforward, and no approver should delay payment because they find it difficult to function.

Automate Your Finances with Synced in Minutes!

How to Choose the Best Expense Automation Software?

The market is flooded with a considerable number of options for expense automation software, each unique in the features it offers, the cons it carries, and the user experience it provides. There are a few crucial things to consider when deciding to invest in the best expense automation software for your business.

Keep scale in mind

The scale and complexity of the organization will be a huge determinant in the kind of applications necessary for smooth workflows. A large company with multiple teams and frequent cross-team functions requires automation software that caters to various use cases. Similarly, a small company with a relatively limited scope requires automation software that caters to its needs. The bottlenecks for different organizations are different. That the investment in automation software is supposed to solve a whole bunch of problems and not create its own set of problems should be kept in mind.

Speed, complexity, and use cases are crucial to consider when choosing expense automation software. However, regardless of the size of the operation, the ease of use of the application itself should also be an important priority. Intuitive user experience will accelerate employee adoption of it. If it’s clunky with a steep learning slope, it will become a nuisance for the employees to deal with.

Discuss with your team

A comprehensive discussion about setting the intention of why we are selecting the expense automation software. A detailed dialogue with employees will also lead to insights about what should be the priority in terms of features, what problems they are facing with the traditional setup and recommendations for the various expense automation software itself.

Consider the level of support you need

You can choose the provider who can best meet your requirements and support you on your journey by being aware of their support models. Even if you don’t expect any issues, it’s still helpful to know what each service can do to assist. Consider:

- How can I reach client service? Do they offer numerous communication options (phone, email, live chats, etc.)?

- Is client service quick to respond? Do they respond to you promptly?

- Is the provider’s location outside of your time zone? Are you or any of your staff members regularly traveling through time zones? Will that have an impact on how you contact support?

- What tools and training documents does the vendor offer? Which teaching techniques—live training workshops, videos, written walkthroughs, articles, etc.—work best for you and your staff?

- Are the company’s present clients happy with the assistance they have received? What are their internet client testimonials saying?

Make sure it can be customized according to your needs

The potential to customize expense management software is part of its allure. The secret is to use software that can evolve along with your business. Keep in mind the following questions when considering an expense automation software:

- Can the workflows for approvals, reimbursements, and other steps involving expense reporting be customized?

- Is the system frequently enhanced and upgraded with new functions?

- How will it integrate with other software? Can standalone expense management software easily connect with your HR software and other external systems if you choose it?

Ensure data safety

Last but not least, spending management software keeps a tonne of information about your workers and business. It should therefore have a strong data security system in effect.

In addition, it must follow all applicable laws and regulations. Always be aware of who has access to your company’s information, and give various levels of access to different employees. Some crucial inquiries to make:

- How are your data stored and protected by each provider?

- Your data is accessible to whom?

- Can you give various employees in your company varying levels of access and authorization?

- Is the program following all applicable rules and laws?

How can Synced help solve your problems?

Synced leverages the power of AI to help you take control of your business processes. Synced is a single, customizable solution that allows businesses to manage their expenses – from purchase to payment. The Synced platform assists businesses to automate their accounts payable, bookkeeping, and compliance processes.

Synced will help you with:

Manage Cashflow: Our payment scheduling solutions allow businesses to pay suppliers with the confidence of knowing there is sufficient cash flow in the business.

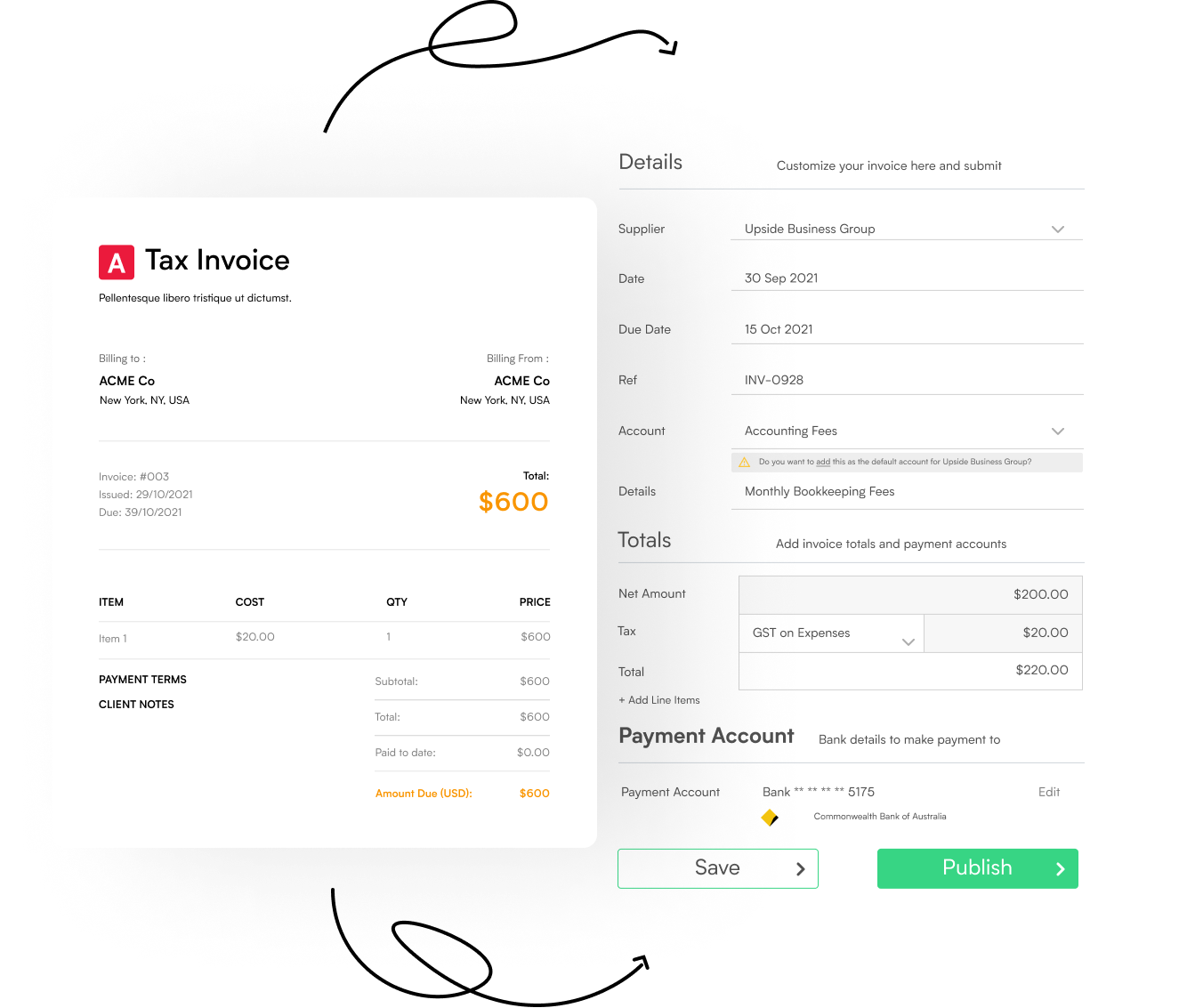

Eliminate Data Entry: Stop wasting time manually copying data from an invoice. Leverage the power of AI to extract the required information and publish it to your accounting software. With 99.7% accuracy, Synced’s smart tech allows users to save time and reduce human errors.

From Purchase to Pay: In addition to key invoice information, our tech also extracts and securely stores supplier banking information. This means that bills can be processed & scheduled for payment in one seamless workflow.

Advanced-Data Extraction: Our technology extracts supplier invoice information (due date, amount, tax) as well as information such as payment account details, job codes, and more.

Always Up To Date: Transactions recorded in Synced are sent to your accounting software in real-time, ensuring your financial data is always up to date.

Automate Your Finances with Synced in Minutes!

Tools that can be Integrated with Synced

Integrate with Xero seamlessly

Keep all your data accurate & up to date with the efficient integration of Synced with Xero. Get a seamless view of all your most important financial data. The integration with Xero gives you visibility in your bills, contacts, accounts, tracking categories, and tax rates.

- Send bills to Xero instantly: You can send bills to Xero quickly with just the click of a button with all relevant data extracted from your supplier invoices and sent to Xero.

- Tracking category extraction: You can extract & map tracking category information from invoices such as job codes, customer names, and locations.

Synced & Xero are the perfect financial management solutions.

Integrate with QuickBooks Online

With the easy integration of Synced with QuickBooks Online, keep all of your data correct and updated. Get a seamless picture of all of your crucial financial information with the integration of QuickBooks Online. It gives insights into bills, contacts, accounts, classes and locations, and tax rates.

- Send invoices to QBO instantly: You can send bills to QuickBooks Online quickly with just the click of a button with all relevant data extracted from your supplier invoices and sent to QuickBooks Online.

- Tracking category extraction: You can extract & map tracking category information from invoices such as job codes, customer names, and locations.

Synced and QBO – The ideal solution for financial management.

How Will Synced Benefit Your Business?

Synced as a platform can benefit your business in numerous ways. Try out Synced in your business and boast of unprecedented efficiency. Synced works in the following ways:

- Invoice processing: Simply upload or email your invoices and our technology processes in seconds.

- Bill approval: Embed approval workflows to ensure all spend is reviewed before payment.

- Supplier payments: Pay on your terms, using the methods that you use in your business.

- Reporting: Get customized insights delivered on a schedule you define.

- Bookkeeping: Our 2-way synced with Xero & QBO ensure your books stay up to date.

- Taxes: Capture all your business expenses and maximize your deductions.

Send documents to your finance teams in real-time via and collaborate in one place on any missing paperwork. Take the stress out of managing all your business expenses. Synced was developed by financial experts. We are always on hand to support your business.

Simply forward your bills to Synced and our tech will take care of the rest.

Want To See Synced in Action? Book a demo with one of our Synced experts and see how it can automate your workflows. Contact us at support@syncedhq.com. Synced is designed to scale your business as it grows. Synced automation software is the one-stop solution for your expense-related problems. Let Synced help your business thrive!