Table of Content

If you’re a business owner or an accountant in Australia, it’s essential to ensure that you’re recording GST (Goods and Services Tax) correctly on supplier invoices. Recording GST accurately can prevent penalties and fines from the Australian Taxation Office (ATO) and help you avoid unnecessary headaches. Here are three things to lookout for when recording GST paid:

Check If the Supplier is Registered for GST

Before recording GST on supplier invoices, make sure to check if the supplier is registered for GST. You can do this by looking at the supplier’s invoice or contacting them directly. If the supplier is not registered for GST, you don’t need to record GST on their invoice. However, if they are registered for GST, you need to ensure that you record the GST amount correctly.

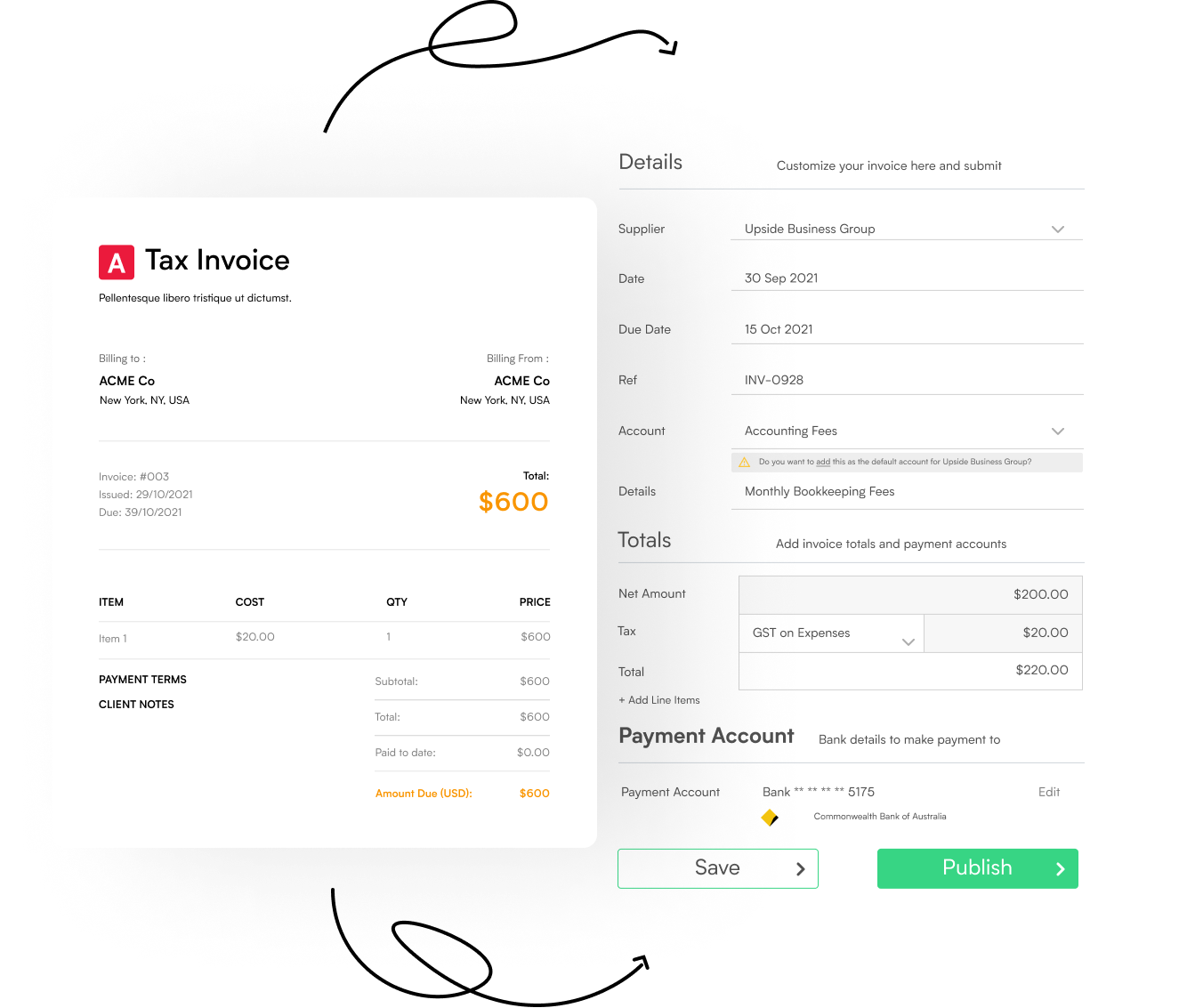

Ensure the GST Amount is Calculated Correctly

When recording GST on supplier invoices, ensure that the GST amount is calculated correctly. The GST rate in Australia is currently 10%, which means that the GST amount is 1/11th of the total amount. For example, if the total amount on the supplier’s invoice is $110, the GST amount would be $10. If you record the GST amount incorrectly, it can cause issues with your BAS (Business Activity Statement) lodgement, which can result in penalties and fines.

Record the GST Amount in the Correct Account

When recording GST on supplier invoices, it’s crucial to ensure that you record the GST amount in the correct account. The ATO requires businesses to record the GST amount in a separate account called the “GST Paid” account. Recording the GST amount in the wrong account can cause issues during tax time and make it challenging to reconcile your books.

In conclusion, recording GST accurately is crucial for businesses and accountants in Australia. By following these three simple steps, you can ensure that you’re recording GST correctly on supplier invoices and avoid penalties and fines from the ATO.