Table of Content

What is Accounts Payable Automation?

Accounts payable automation is the use of technology to automate and streamline accounts payable procedures. This eliminates manual operations (such as paper processing and manual invoice keying) and improves visibility and control of crucial financial data. Automation of accounts payable aids in spending control and provides information that enables better decision-making.

Accounts payable automation provides a digital workflow to manage processes that were previously handled by an AP staff member, enabling businesses to process supplier invoices touchless. Holistic accounts payable automation makes it possible to process business payments automatically from beginning to end.

Why do We Need to Automate Accounts Payable?

Accounts payable automation, as its name suggests, refers to tools or processes that automate the manual components of accounts payable. This is usually accomplished with the use of specialized software.

A manual accounts payable process can be time-consuming and prone to mistakes, as most finance teams are all too aware of. In addition to being time-consuming, sorting through mountains of paper invoices, contacting each appropriate approver one by one, and delivering checks leaves the business vulnerable to fraud and complicates audits.

The goal of accounts payable automation (AP automation) technology is to handle this back-end financial process in a way that is more effective, quick, and accurate. AP automation can help you save time and money by getting rid of manual processes and piles of paper. It also reduces the number of days of sales outstanding (DSO), which helps your cash flow. Building intricate ledger files and entering many rows of data are no longer necessary. You can produce reports with just a few clicks using key formulae that are built-in. The goal is to streamline previously extremely complicated processes and make accounting more efficient as a whole.

The use of accounting software is nothing new. However, up until recently, using this equipment required a lot of human labor and took a long time. The least efficient parts of an accountant’s job are now eliminated by accounting technology, giving them more time for analysis, strategy, and interpersonal interactions.

What are the Benefits of AP Automation?

Most of the time, automation simply makes life easier for everyone. Let’s look at the benefits of automation as it is still an investment (albeit one that often pays for itself).

- Reduces time: Checking purchase order forms and entering data, which used to take time and required repetition, may now be completed almost instantly.

- Automatically digitizes documents: Paper filing and enormous storage facilities are out. Why not go digital from the start, as opposed to filling out paper purchase orders, scanning them, and sending them around the office?

- Improved efficiency: Automating the accounts payable process can help to reduce manual data entry, minimize errors, and speed up the overall process, which can save time and resources for the organization.

- Cost savings: By automating the accounts payable process, organizations can save on the costs associated with manual processing, such as paper, ink, and labor costs. Additionally, automated systems can help to identify duplicate payments and prevent overpayments, which can further reduce costs.

- Enables access to AP from anywhere: Paperwork typically needs to be done at the proper location. Papers must be filed in the appropriate cabinet and placed in the appropriate in-tray. Yet, if a digital process is cloud-based, it can be carried out from any location with an internet connection.

- Makes work more productive: When tedious, manual work can be avoided, your teams will have more time to focus on the tasks that are important to them. It naturally starts with finance, but it also involves other teams that waste time trying to figure out how accounts payable works.

- Increased accuracy: Automation can help to minimize errors that can occur in manual processing, such as data entry errors or miscalculations, leading to more accurate financial reporting.

- Improved vendor relationships: Automation can help to streamline the payment process and reduce the time it takes to process payments, which can lead to improved relationships with vendors.

- Enhanced reporting and analytics: Automated systems can provide real-time data and insights into the accounts payable process, allowing for better tracking of expenses, identification of trends, and improved decision-making.

Overall, accounts payable automation can help organizations to save time, reduce costs, increase accuracy, improve vendor relationships, and gain valuable insights into their financial operations.

Automate Your Finances with Synced in Minutes!

How Does it Work?

AP automation, or accounts payable automation, refers to the use of technology to streamline and automate the accounts payable process. The goal of AP automation is to improve efficiency, reduce errors, and save time and money.

Here’s a general overview of how AP automation works:

- Capturing invoices: The first step in AP automation is to capture the invoice data. This can be done in several ways, including scanning paper invoices, receiving invoices via email, or using electronic data interchange (EDI) to receive invoices directly from vendors.

- Data extraction: Once the invoices are received, the system uses optical character recognition (OCR) technology to extract the relevant data, such as the invoice number, vendor name, and amount due. The system may also use machine learning algorithms to improve the accuracy of the data extraction.

- Validation and approval: The system then checks the invoice data against the company’s purchase orders and other relevant information to ensure that the invoice is valid. The system can also route the invoice to the appropriate person for approval, based on the company’s approval workflows.

- Payment processing: Once an invoice is approved, the system generates a payment and sends it to the vendor. This can be done electronically, via ACH or wire transfer, or by printing a physical check.

- Reporting and analysis: Finally, the system generates reports that provide insight into the company’s AP process, such as how long it takes to process invoices, how many invoices are processed each day, and how much the company is spending on each vendor.

Overall, AP automation can help companies save time and money, reduce errors, and improve visibility into the AP process.

How can Synced Help You with Accounts Payable Automation?

Synced is an end-to-end expense management platform. It provides tools and workflows to enable businesses to streamline their accounts payable and expense management processes.

Synced is a single, customizable solution that allows businesses to manage their expenses – from purchase to payment! The Synced platform helps businesses automate their accounts payable, bookkeeping, and compliance processes. Synced leverages the power of AI to help you take control of your business processes.

Synced takes care of:

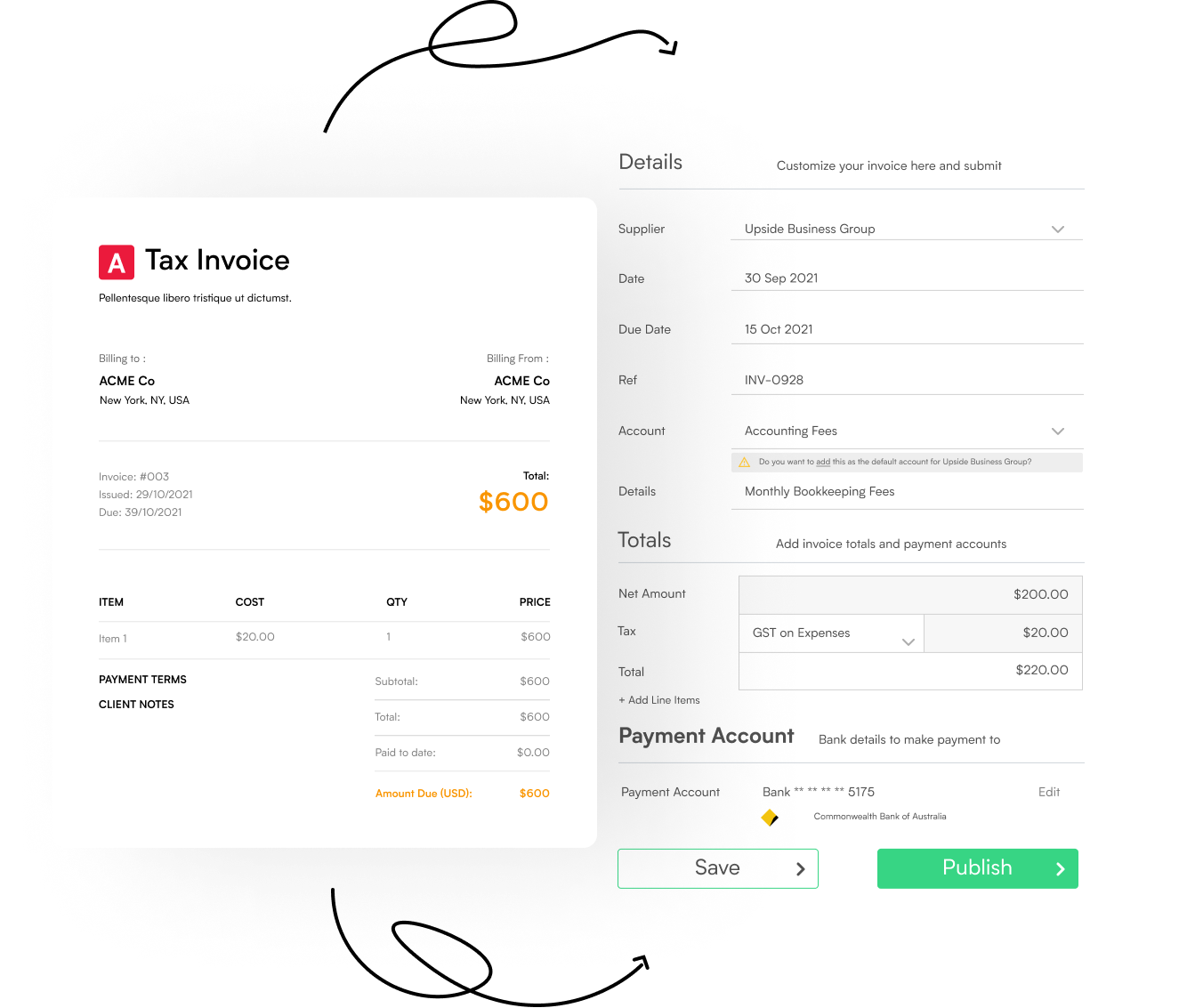

- Supplier invoice processing: Simply upload or email your invoices and our technology processes in seconds. Put your AP on auto-pilot – automate the receipting, processing & scheduling of supplier invoices. Save time and errors associated with manual data entry.

- Bill approval: Embed approval workflows to ensure all spend is reviewed before payment.

- Supplier payments: Pay on your terms, using the methods that you use in your business.

- Reporting: Get customized insights delivered on a schedule you define.

- Bookkeeping: Our 2-way synced with Xero & QBO ensure your books stay up to date.

- Taxes: Capture all your business expenses and maximize your deductions.

Take the stress out of managing all your business expenses. Simply forward your bills to Synced and our tech will take care of the rest.

Why Choose Synced?

- Manage Cashflow: Our payment scheduling solutions allow businesses to pay suppliers with the confidence of knowing there is sufficient cash flow in the business.

- Eliminate Data Entry: Stop wasting time manually copying data from an invoice. Leverage the power of AI to extract the required information and publish it to your accounting software. With 99.7% accuracy, Synced’s smart tech allows users to save time and reduce human errors

- From Purchase to Pay: In addition to key invoice information, our tech also extracts and securely stores supplier banking information. This means that bills can be processed & scheduled for payment in one seamless workflow.

- Advanced-Data Extraction: Our technology extracts supplier invoice information (due date, amount, tax) as well as information such as payment account details, job codes, and more

- Always Up To Date: Transactions recorded in Synced are sent to your accounting software -in real-time, ensuring your financial data is always up to date.

Snap, send, and done! Send documents to your finance teams in real-time via and collaborate in one place on any missing paperwork. Take the stress out of managing all your business expenses. Synced was developed by financial experts. We are always on hand to support your business.

Simply forward your bills to Synced and our tech will take care of the rest. Want to see Synced in action? Book a demo with one of our Synced experts and see how it can automate your workflows. Contact us at hello@simpletesting.website. Synced is designed to scale your business as it grows. Let automation boost your company’s growth.