Table of Content

As businesses grow, expenses become more complex and difficult to manage. Keeping track of receipts and invoices can be a daunting task, especially for small business owners. Fortunately, technology has made it easier to automate expense management using Optical Character Recognition (OCR) software. OCR technology is designed to convert scanned images or documents into machine-encoded text, making it easier to store, search and analyze. In this article, we’ll explore how OCR technology can make expense management easier and more efficient.

Improved Accuracy and Efficiency

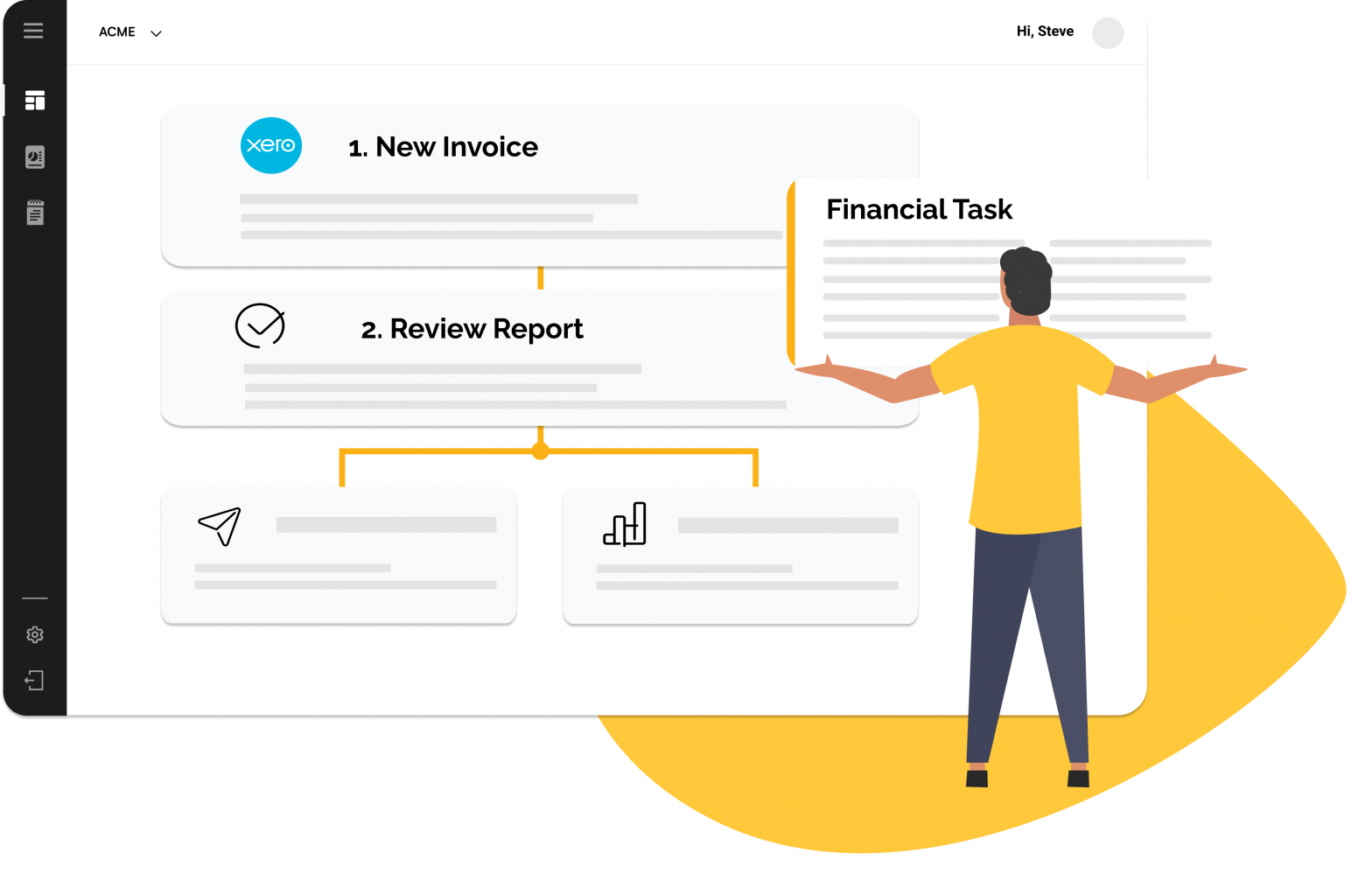

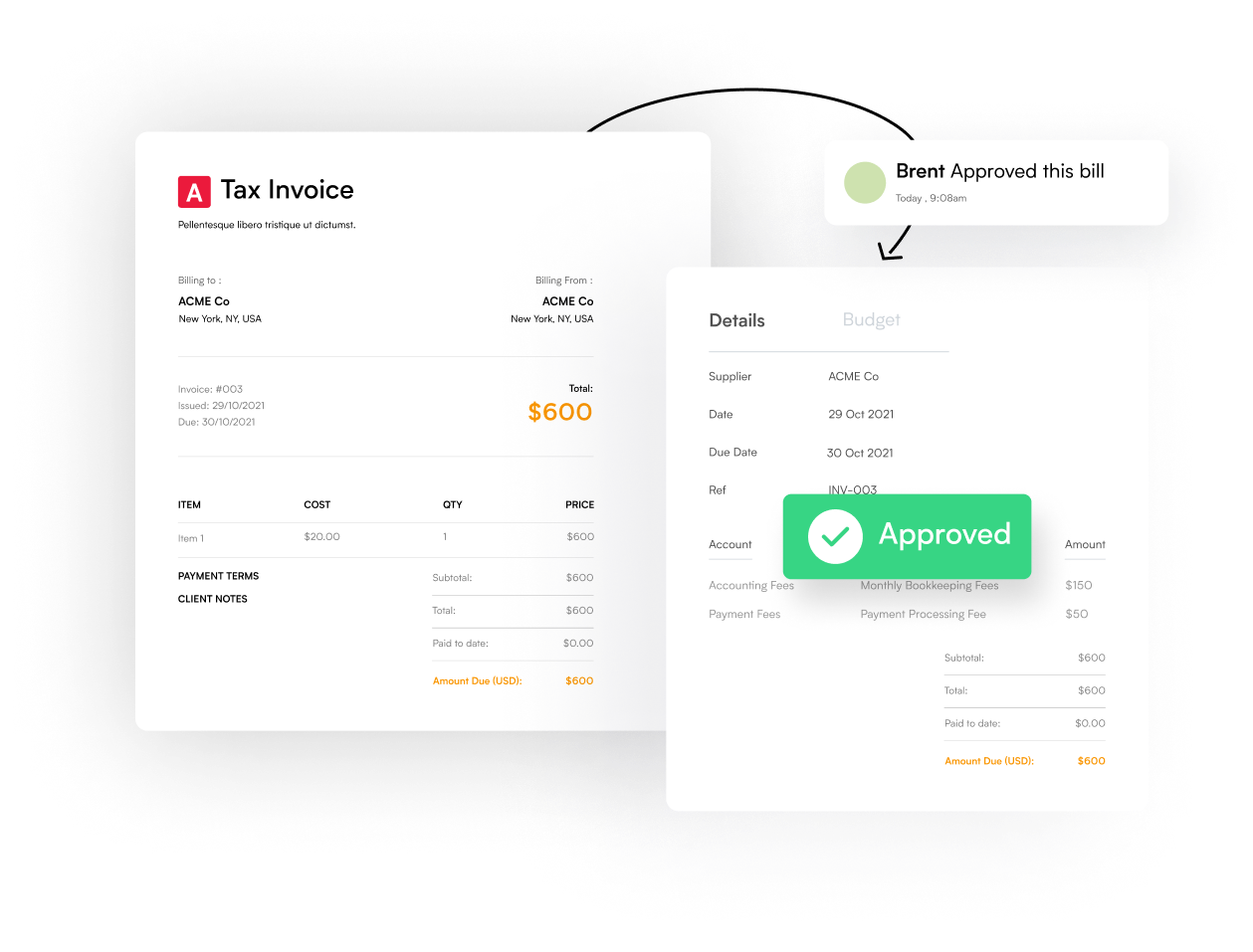

Manual data entry can be slow and error-prone, leading to mistakes in expense reports. OCR technology can help eliminate these errors and increase efficiency by automating the data entry process. By scanning receipts and invoices, the software can extract important information such as the date, vendor name, and amount, and then input it into your expense management system. This not only saves time but also reduces the risk of human error.

Cost and Time Savings

Automating expense management using OCR technology can also save businesses money. By reducing the time and effort required to input data, employees can focus on other tasks, increasing productivity. Additionally, businesses can save money on paper and ink costs, as well as reducing the need for physical storage space. With OCR technology, businesses can store all their expense data digitally, reducing the need for physical copies.

Improved Accessibility and Security

By automating expense management using OCR technology, businesses can improve accessibility to data. Instead of keeping receipts and invoices in filing cabinets, all data can be stored digitally and accessed from anywhere. Additionally, OCR technology can help improve security by reducing the risk of data loss or theft. By storing data digitally, businesses can ensure that their expense data is safe and secure.

Conclusion

Automating expenses using OCR technology can help businesses save time, money, and reduce the risk of errors. By improving accuracy, efficiency, accessibility, and security, OCR technology can make expense management easier and more efficient. As technology continues to evolve, businesses that adopt OCR technology will be better equipped to manage their expenses and stay competitive in their industries.