Table of Content

Xero is a powerful accounting software that can help streamline your business finances. However, to get the most out of Xero, it’s important to use it correctly. Here are five basics to ensure you’re using Xero correctly.

Set Up your Chart of Accounts Properly

Your chart of accounts is the backbone of your accounting system. It’s crucial to set it up properly from the beginning. Make sure you include all the accounts you need, such as assets, liabilities, income, and expenses. Also, consider using sub-accounts to help you track your finances more accurately.

Reconcile your Accounts Regularly

Reconciling your bank and credit card accounts in Xero is an important step to ensure that your financial records are accurate. By reconciling your accounts, you can identify any discrepancies and correct them before they become bigger problems.

Use Xero’s Invoicing and Payment Features

Using Xero’s invoicing and payment features can save you time and make your invoicing process more efficient. You can create and send invoices directly from Xero and even set up automatic payment reminders for your customers.

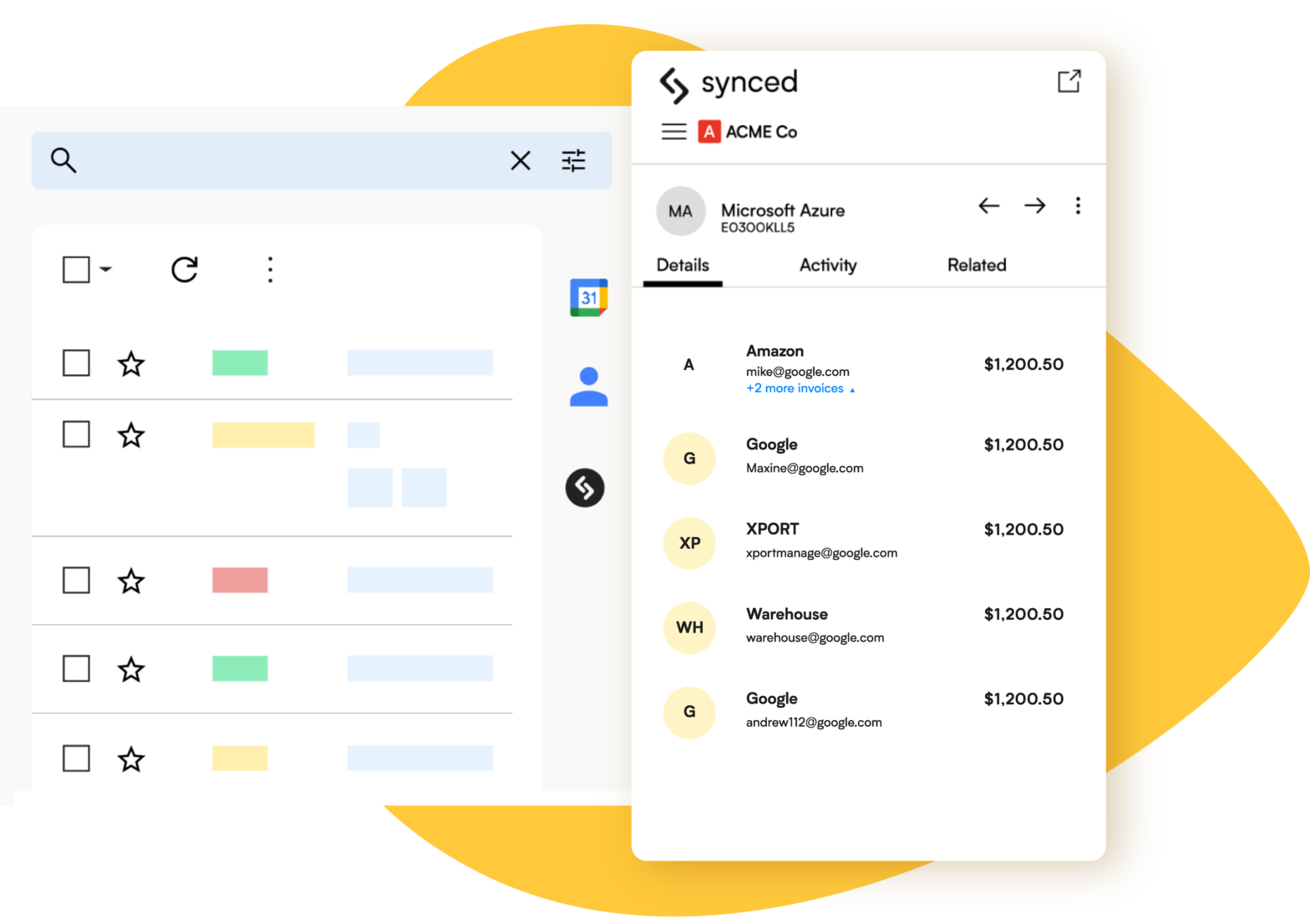

Automate Your Finances with Synced in Minutes!

Use Xero’s reporting features

Xero’s reporting features can help you get a better understanding of your business’s financial health. You can generate reports on your income and expenses, cash flow, and more. By reviewing these reports regularly, you can make informed decisions about your business’s future.

Keep your Xero Account Secure

Protecting your Xero account is essential to keeping your financial information safe. Make sure you use a strong password and enable two-factor authentication. Also, limit access to your Xero account to only those who need it.

By following these five basics, you can ensure that you’re using Xero correctly and getting the most out of this powerful accounting software.