Table of Content

One of the most critical aspects of running a successful business is paying your suppliers on time. Late payments can negatively affect your relationships with suppliers and even damage your credit score. However, manually managing supplier payments can be time-consuming and prone to mistakes. Fortunately, there are several ways to streamline the payment process and reduce the risk of errors. In this blog post, we will discuss three ways to reduce time and mistakes when paying suppliers.

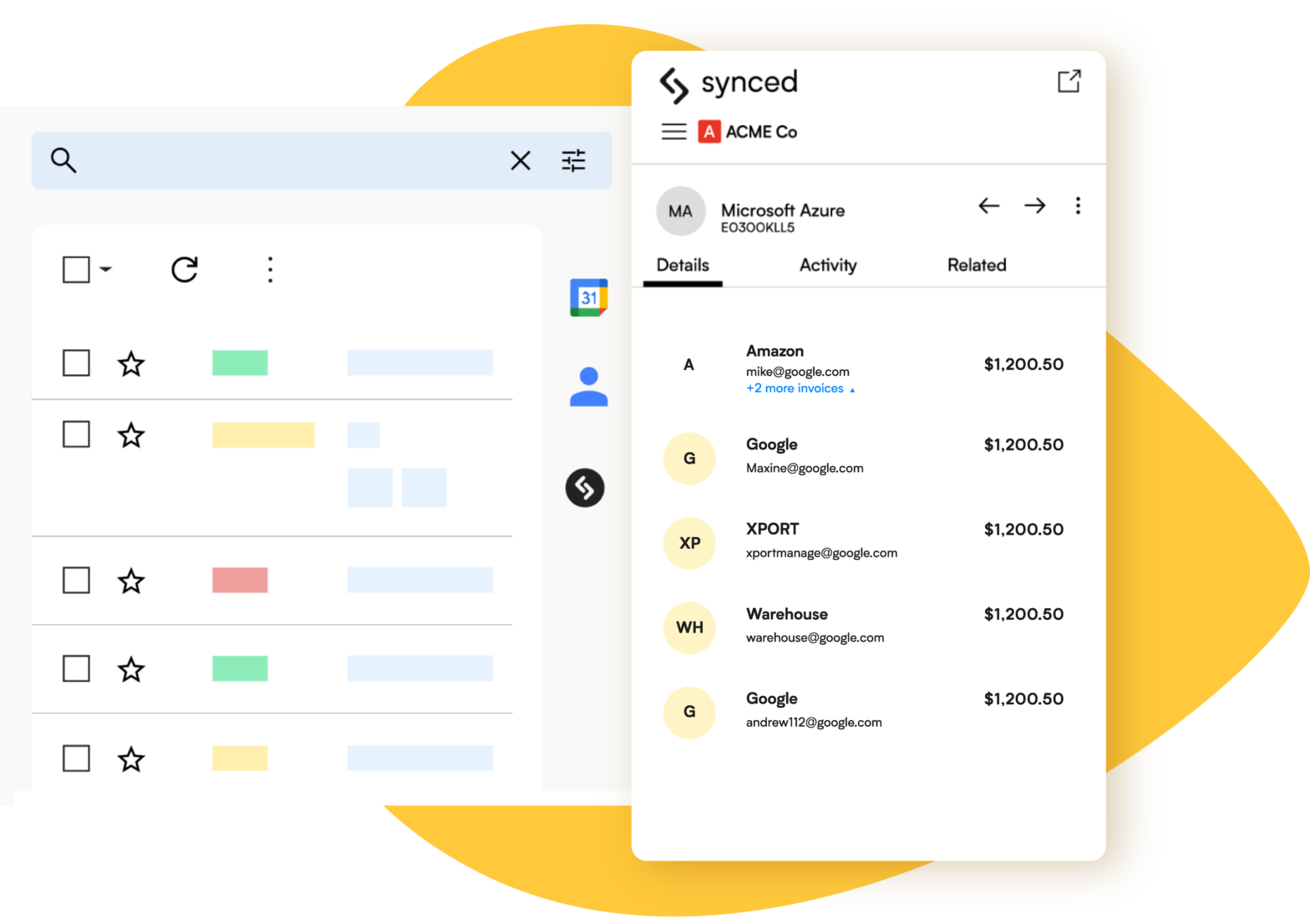

Automate Your Inbox

By integrating directly with your inbox, your expenses can be submitted for processing as soon as they’re received.

Automate Your Payment Process

One of the most effective ways to reduce the time and mistakes involved in paying suppliers is to automate the payment process. By using an accounting software or payment platform, you can set up recurring payments to your suppliers, eliminating the need for manual entry each time. These platforms also offer additional features like payment tracking and reminders to ensure that payments are made on time. Automating your payment process not only saves time but also reduces the risk of errors caused by manual entry.

Use Electronic Payments

Another way to reduce the time and mistakes involved in paying suppliers is to use electronic payments. Electronic payments, such as ACH transfers or wire transfers, eliminate the need for paper checks and manual processing. Electronic payments also offer faster processing times and increased security compared to traditional paper checks. By using electronic payments, you can reduce the risk of errors and ensure that payments are made quickly and securely.

Conclusion

Paying suppliers on time is essential for maintaining positive relationships and a healthy credit score. However, manually managing supplier payments can be time-consuming and prone to errors. By automating your payment process, using electronic payments, and implementing a supplier portal, you can reduce the time and mistakes involved in paying suppliers. These solutions not only save time but also increase transparency and security in the payment process. Implementing these strategies can help you build stronger relationships with suppliers and improve the overall efficiency of your business.