The Daily Sync

Tips, guides and insights for better business finances

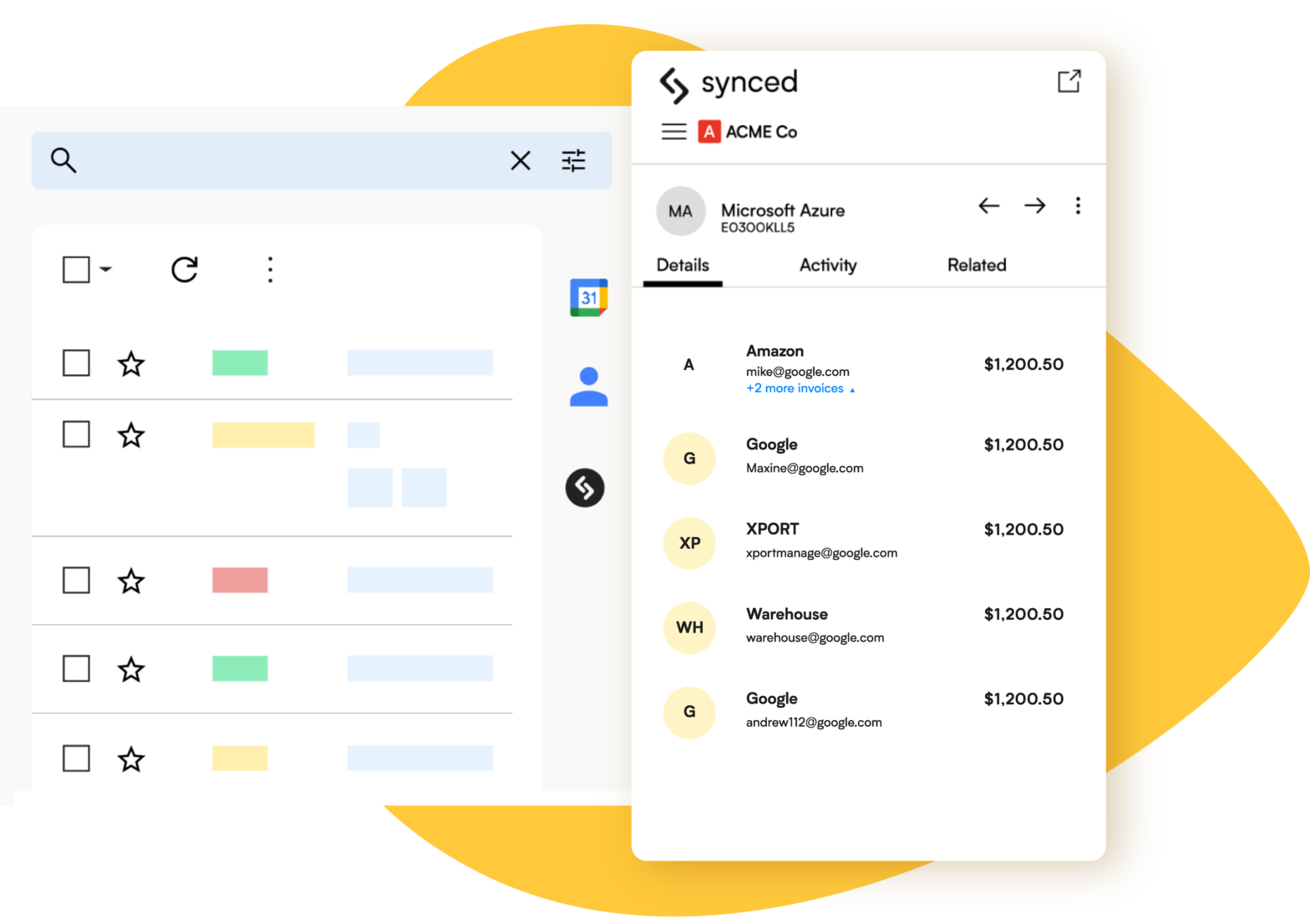

The Synced Gmail extension intelligently detects and extracts relevant information such as vendors, dates, and amounts from invoices or receipts received in your Gmail inbox. With its seamless integration into Gmail, this extension brings a host of time-saving features right into your inbox.

AI can help improve the accuracy of accounting work and reduce the risk of errors. By automating data entry and analysis, AI can help eliminate the human error that can occur when accountants are manually entering data into spreadsheets.

One of the most critical aspects of running a successful business is paying your suppliers on time. Late payments can negatively affect your relationships with suppliers and even damage your credit score. However, manually managing supplier payments can be time-consuming and prone to mistakes.

Are you struggling with managing your business finances? Synced and Dext are two companies that offer solutions to this problem. In this article, we will compare the advantages of Synced versus Dext.

When it comes to document management, Synced and Hubdoc are two popular options that offer similar services. However, there are some key differences between the two that are worth exploring.

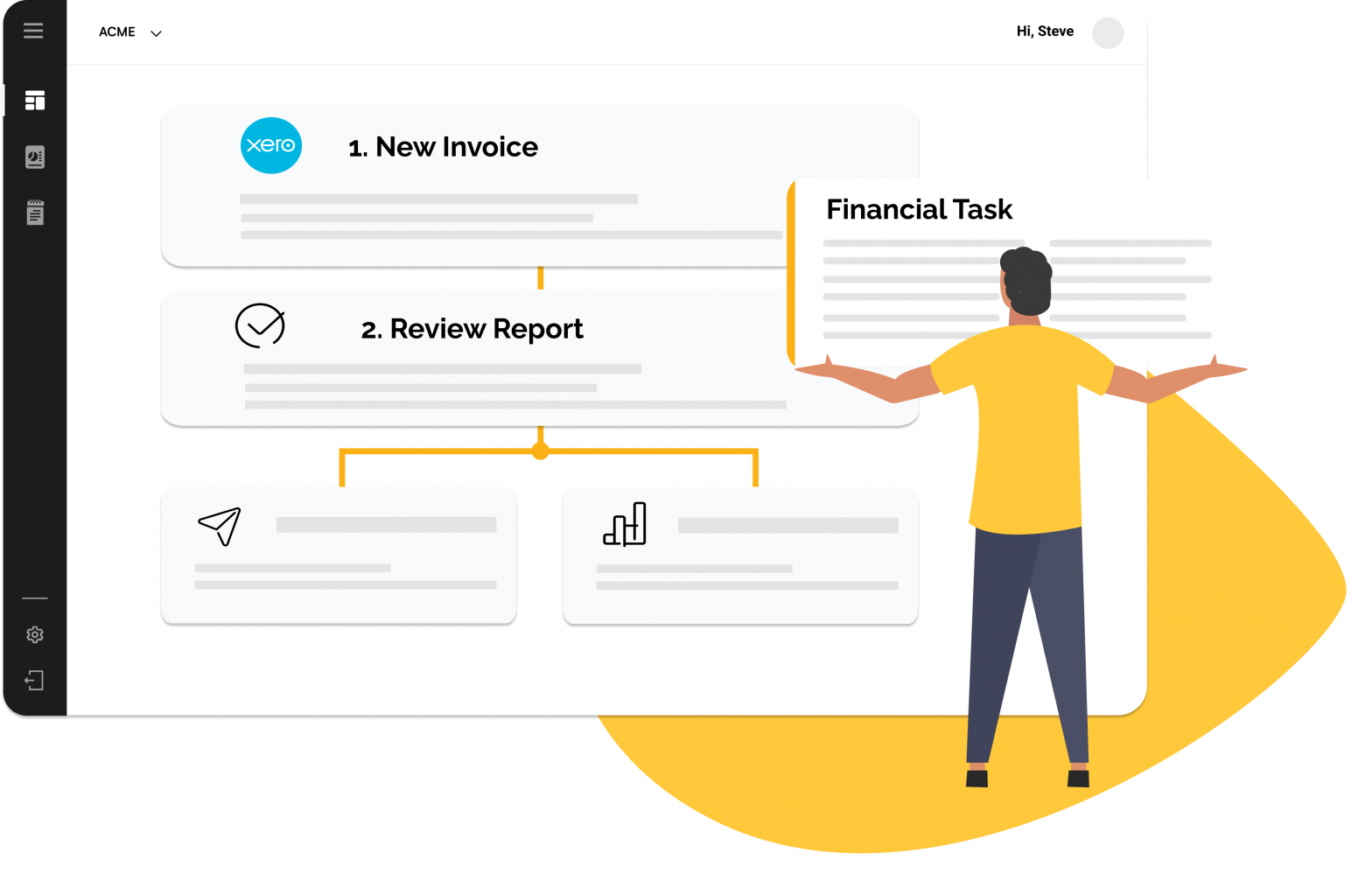

Xero is a powerful accounting software that can help streamline your business finances. However, to get the most out of Xero, it’s important to use it correctly. Here are five basics to ensure you’re using Xero correctly.

QBO has a wide range of reports that can help you make informed decisions about your business. Use them to analyze your income and expenses, track your cash flow, and monitor your profitability. Make sure you’re running reports regularly to stay on top of your financials.

First things first, we had to introduce ChatCPT to the world of accounting. We gave it a crash course on bookkeeping, financial statements, and tax filings. Surprisingly, ChatCPT was a quick learner and grasped the basics in no time. To our surprise, ChatCPT finished the task in half the time it would take a human accountant. We were impressed!

Before recording GST on supplier invoices, make sure to check if the supplier is registered for GST. Read more!

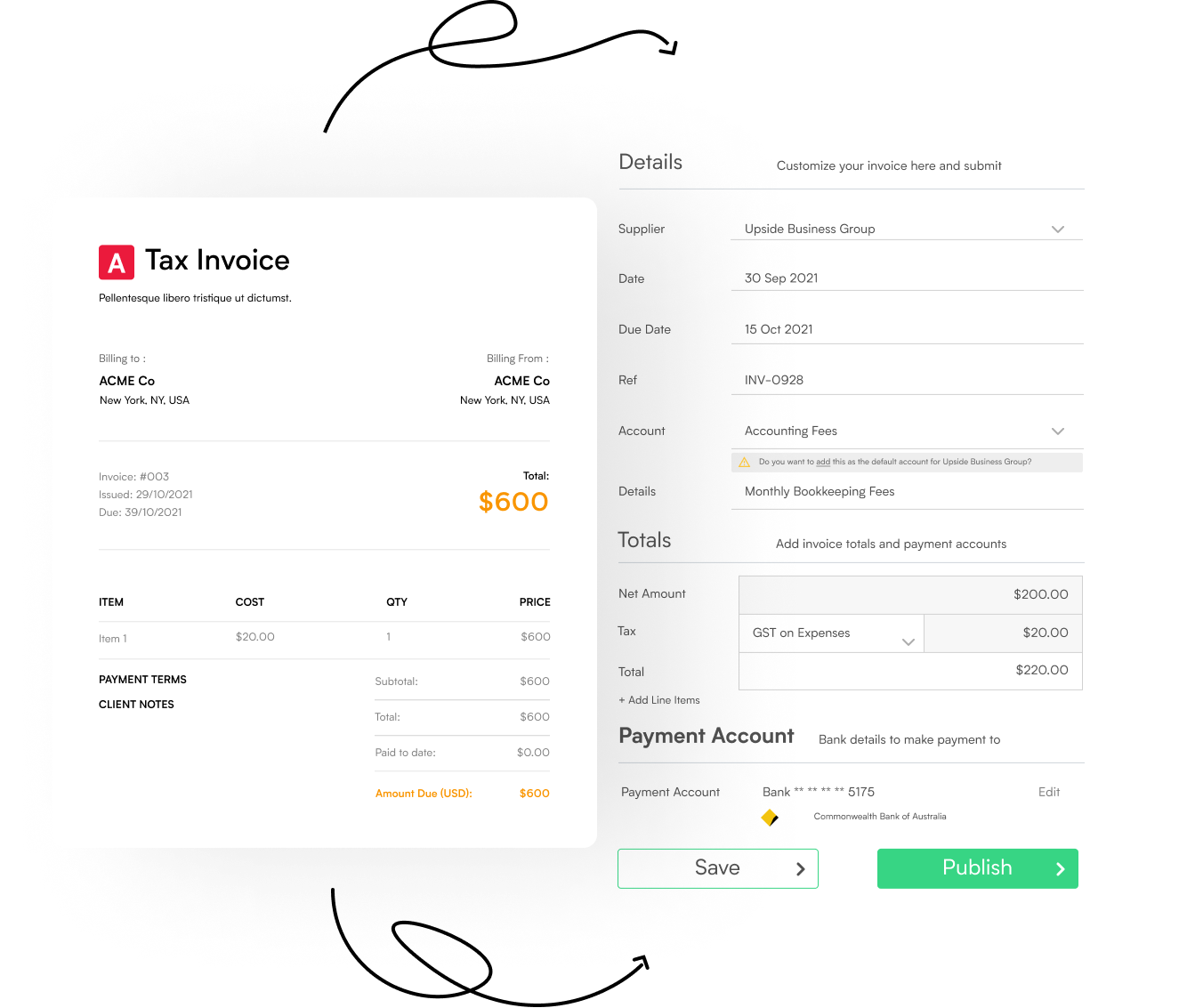

By following the steps outlined in this article, you can easily automate your expense processing using OCR and streamline your business operations. Learn how.

OCR technology is designed to convert scanned images or documents into machine-encoded text, making it easier to store, search and analyze.

Accounts payable automation is the use of technology to automate and streamline accounts payable procedures. Learn more.

Finance automation is the process of using technology and software to automate financial processes and tasks. It has become an essential aspect of modern businesses as it streamlines financial operations and provides numerous benefits. Learn more

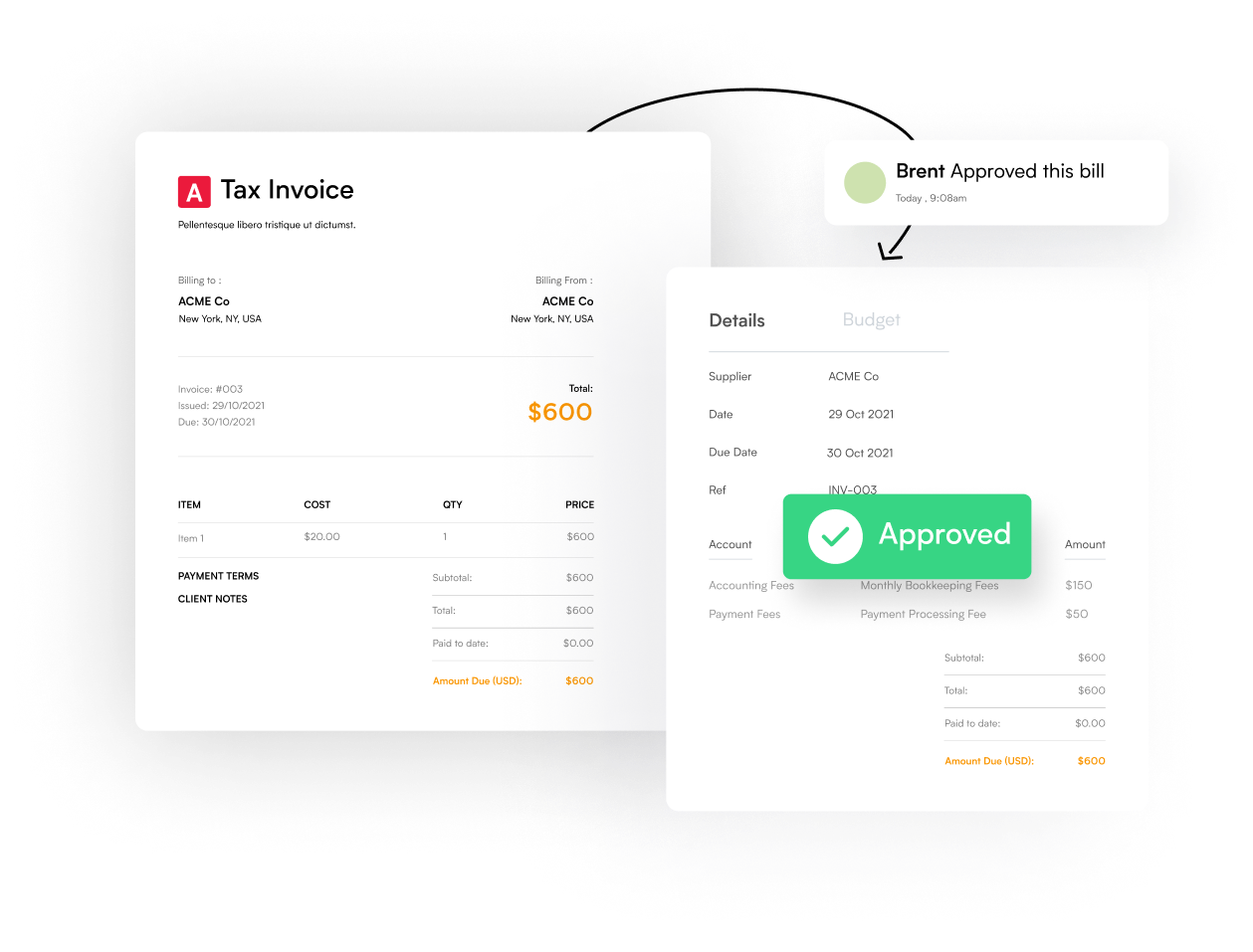

Expense automation software is a centralized, digital environment that assists organizations in automating the manual aspects of the accounts payable workflow, primarily invoice management, approvals, and payments.

Accounting automation is a kind of software that streamlines the accounting process by automating the most labor-intensive operations. These programs are a crucial element of the procedures used by the accounting team.

AP or Accounts payable automation is the application of technology to automate and streamline accounts payable processes. Learn More.