Product

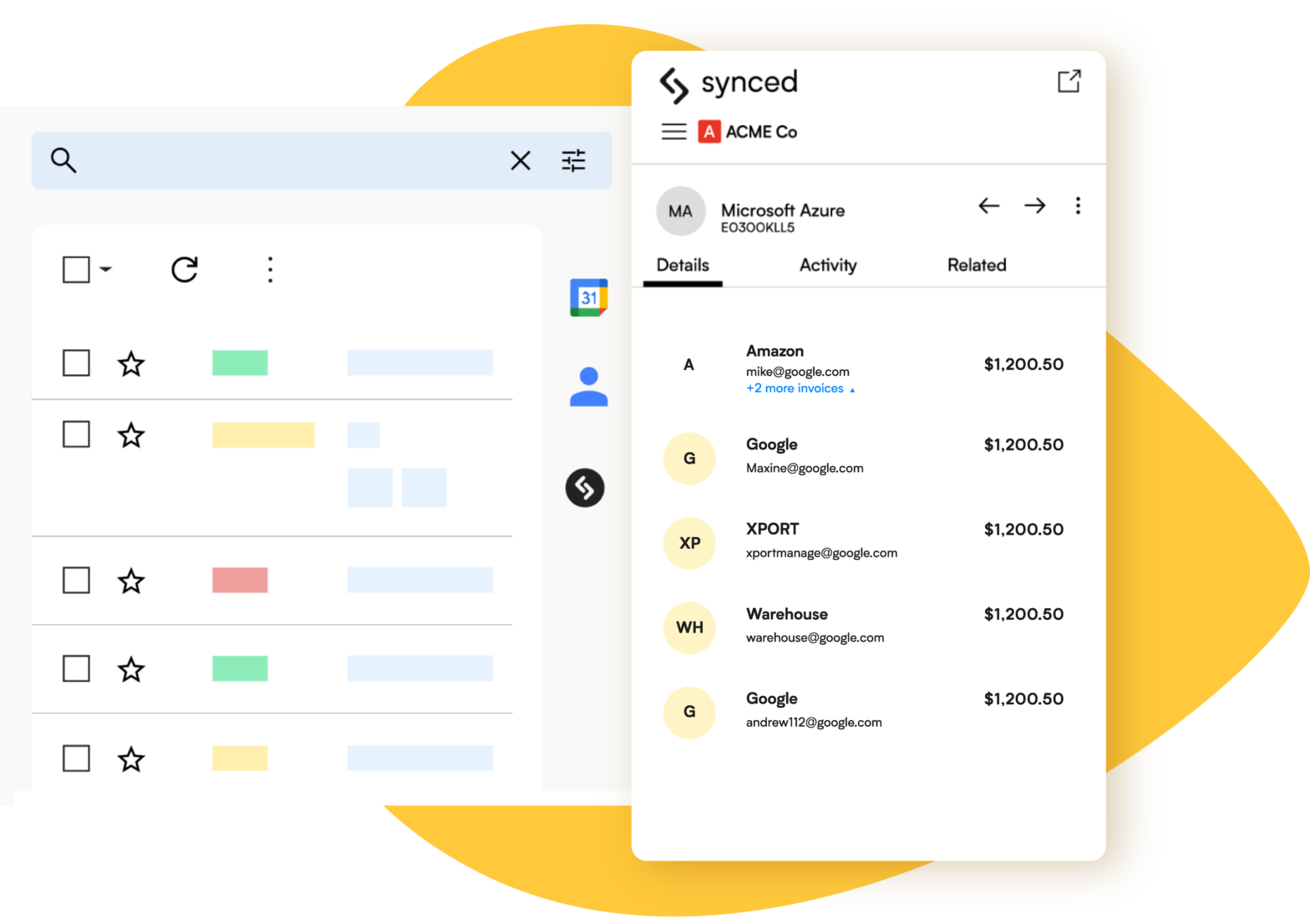

Save 15 Hours A Month With The Synced Gmail Extension

The Synced Gmail extension intelligently detects and extracts relevant information such as vendors, dates, and amounts from invoices or receipts received in your Gmail inbox. With its seamless integration into Gmail, this extension brings a host of time-saving features right into your inbox.

3 Ways To Reduce Time And Mistakes Paying Suppliers

One of the most critical aspects of running a successful business is paying your suppliers on time. Late payments can negatively affect your relationships with suppliers and even damage your credit score. However, manually managing supplier payments can be time-consuming and prone to mistakes.

Synced Advantages vs Dext

Are you struggling with managing your business finances? Synced and Dext are two companies that offer solutions to this problem. In this article, we will compare the advantages of Synced versus Dext.

Synced Advantages vs Hubdoc

When it comes to document management, Synced and Hubdoc are two popular options that offer similar services. However, there are some key differences between the two that are worth exploring.

5 Basics To Ensure You’re Using Xero Correctly

Xero is a powerful accounting software that can help streamline your business finances. However, to get the most out of Xero, it’s important to use it correctly. Here are five basics to ensure you’re using Xero correctly.

5 Basics To Ensure You’re Using QBO Correctly

QBO has a wide range of reports that can help you make informed decisions about your business. Use them to analyze your income and expenses, track your cash flow, and monitor your profitability. Make sure you’re running reports regularly to stay on top of your financials.